A Christmas Slaying for the Magnificent Seven

Reflecting on a resilient market year

It has been another remarkable period for risk assets. Fears of a ‘hard landing’ or recession did not materialise and investors were able to ignore the noise of the largest ever global election cycle as c. 50% of the world’s population took to the polls this year.

Stable growth and declining inflation

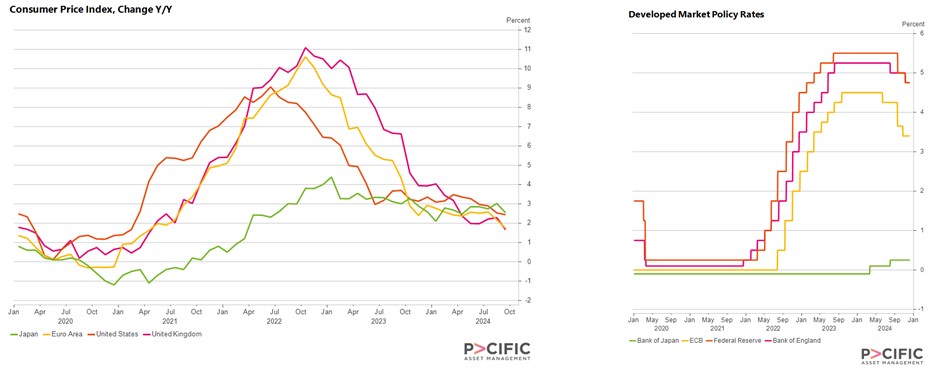

Global growth remained stable and this coincided with headline inflation continuing to fall across the US, UK and Europe and with that, Central Banks in the respective economies have now begun to cut interest rates (see Figure 1).

Figure 1: Consumer Price and Interest Rates (Source: Macrobond)

Diverging growth prospects for 2025

Moving forward I expect the global economy and financial markets to be something of a mixed picture.

The OECD expects Real Global GDP to be 3.3% next year, however we see growth prospects differing significantly between countries. The US economy is forecasted to grow 2.8% next year whereas Germany (the world’s third largest economy) - which faces a combination of political risk home and abroad and an anaemic manufacturing sector - is expected to grow just 0.7% next year1 .

Inflation trends and labour market shifts

Another consideration is the path of inflation as this will be a key determinant as to how many interest rate cuts we see next year.

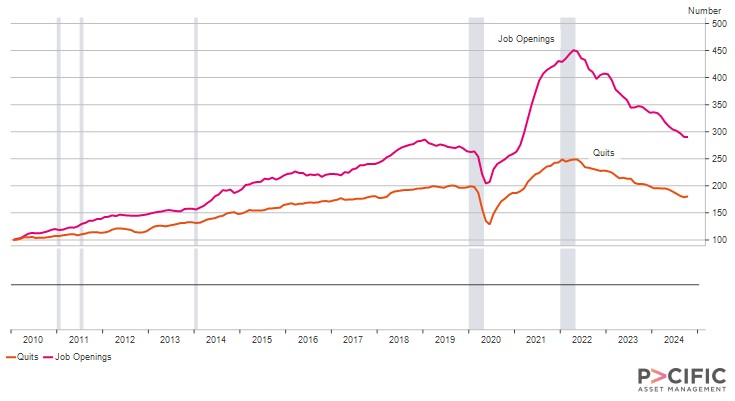

Headline inflation, as mentioned above, has fallen meaningfully, however there are other measures of inflation that Central Banks monitor. One of these is Services inflation which is the measure of prices in the service and hospitality sector. Post- pandemic we saw a distortion in labour markets where there were too few people for the number of jobs available, which saw wage growth in the western world increase as individuals leveraged their position in a limited pool of labour.

However, as the number of job openings has decreased from those post-pandemic highs and the unemployment rate has started to rise, we have started to observe a slowing of pay growth, which has also coincided with some weakening of labour markets.

Additionally, the number of "job quits" in the US has decreased, which offers additional insight into the labour market because, generally speaking, people only want to change professions when there are better roles/openings and when they can earn more money elsewhere (see Figure 2).

Figure 2. US Job Openings and Quits (Source: Macrobond)

Positive outlook for corporate earnings

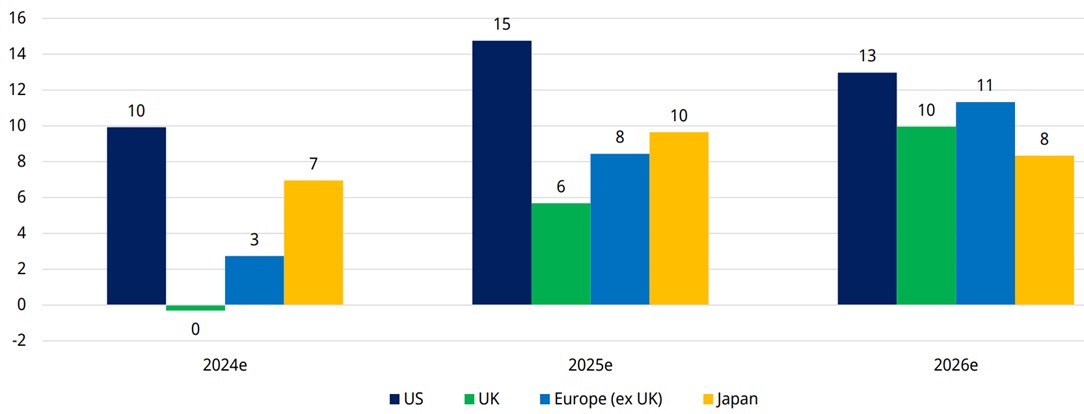

Corporate earnings are expected to improve next year with US corporates (once again) forecasted to produce the highest level of earnings growth.

Figure 3: Corporate Earnings: Consensus YoY EPS growth forecasts % (Source: Schroder Equity Lens – December 2024)

The question as to whether this level of earnings growth will materialise will be key for investors.

US equity market performance and valuations

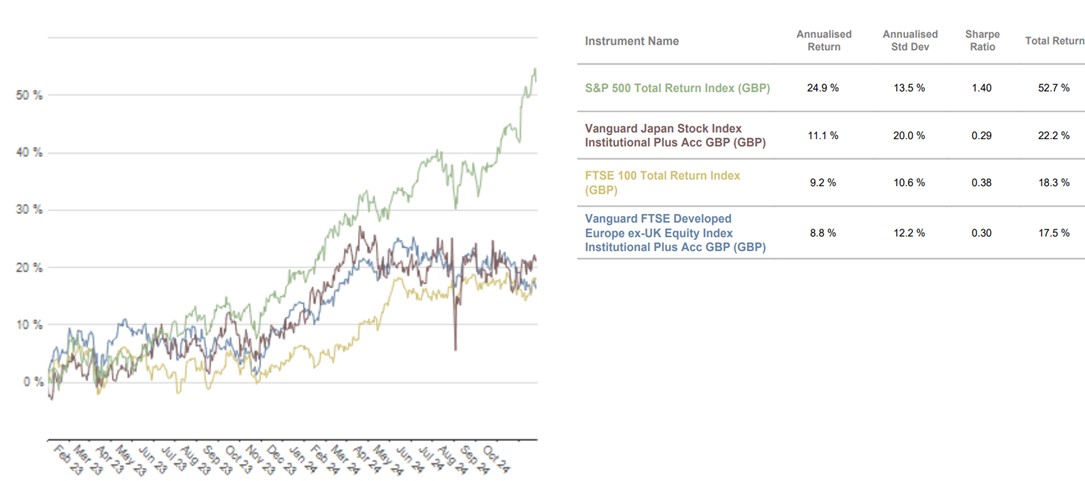

To the end of November, the S&P 500 – an index of the 500 biggest companies in the US – was up c.28% since the start of the year and this followed the less - but still impressive - return of c.19% in 2023. This means (when considering the benefit of compounding) the index is up 53% since January 2023 which is in stark contrast to other regional equity markets where UK, European and Japanese equities returned 17-23% over the same time period (see Figure 4)

Figure 4. Regional equity returns (Source: Pacific Asset Management)

Given this relative outperformance of US equities, if you were to look at the MSCI World index which is made up of the largest c. 1,500 public companies in developed markets based on size (the technical term being market ‘capitalisation’) you would see that US equities make up over 70% of the index. This is why investors should be cognisant that when investing into ‘global equities’ they are in turn (and perhaps inadvertently) investing a significant amount into the US stock market.

What this means from a valuation perspective is that US equities are considered expensive, not just compared to other regional equity markets like the UK, but also relative to its own history.

One could have made this comment several times over the last decade and if you were a valuation purist then you would have missed out on a significant return. That said, when you consider the valuation of the ‘Magnificent 7’ - which collectively represent approximately 30% of the S&P 500 - and compare it with the broader index otherwise known as the S&P 493, then it does raise the question of how much of that future earnings growth is already priced in and whether these companies can continue to produce sales growth in excess of 20% per annum2.

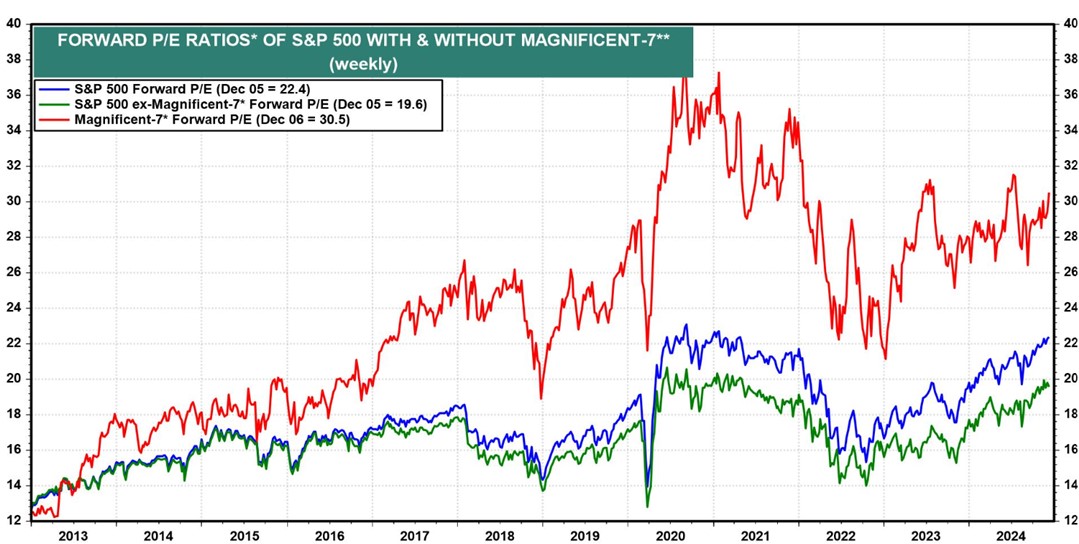

The divergence in valuation between the Magnificent 7 and the broader S&P 500 can be seen below where we are comparing their respective forward price-to-earnings ratios i.e a measure of how much an investor must pay for a company’s forecasted earnings in 12 months’ time.

Figure 5. US equity price-to-earnings ratio (Source: Yardeni – December 2024)

Looking ahead we are certainly not calling an end to the exceptionalism of the US economy and equity market, but we do see a broadening out of this feature.

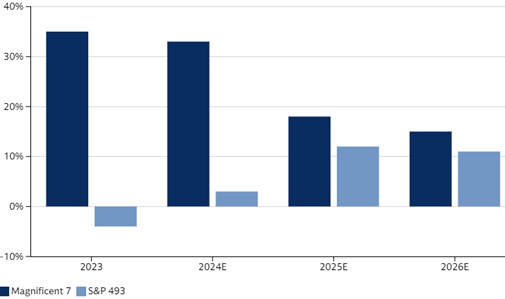

In 2023 the ‘Magnificent 7’ outperformed on an earnings growth basis and they benefited accordingly, however it is expected that we will see an improvement in earnings for companies in the ‘S&P 493’ which when you consider the relatively cheap valuation compared to their ‘magnificent’ peers could represent an opportunity for investors.

Figure 6. US earnings expectations (Source: Goldman Sachs research – December 2024)

Looking ahead to 2025

We will return to the outlook for 2025 in January. However, reflecting on 2024 suggests that next year will be a year where investors should reacquaint themselves with the fundamentals of investing, for instance, companies that are improving their earnings whilst trading at a cheap valuation should do well over the long-term. Having a diversified portfolio will continue to reduce risk but will also provide the opportunity for returns in markets which some investors have (up until recently) neglected.

Notes:

- 1 Figures referenced are from the OECD’s latest economic outlook which was released on 4 December 2024

- 2 The Magnificent 7 refers to Apple, Microsoft, Amazon, Alphabet (Google), Tesla, Nvidia and Meta Platforms.

Investment Champion uses the expertise of the Investment Team at The Private Office to create simple to understand investment portfolios that offer an alternative and cost-effective way to make your money grow. The Investment Champion portfolios provide diversified investment exposure across a range of geographies and asset classes in order to produce attractive risk-adjusted returns for investors. These portfolios use passive funds which track the performance of a benchmark and are not actively managed by a fund manager. They therefore offer a cost-effective solution to building a portfolio.

The information in this article is correct as at 13/12/2024.

This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Investment returns are not guaranteed, and you may get back less than originally invested; past performance is not a guide to future returns.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright