Omicron moves markets and expectations

Market Update - December 2021

With the announcement of a new COVID-19 variant known as "Omicron" by the World Health Organisation (WHO), markets have a sense of déjà vu.

This comes as the economy was picking up steam and the recovery was well underway. It will create short-term headwinds, but the long-term recovery will continue as Governments and Health services deal with the impacts of Omicron.

In this month’s update, we look at the potential impact this variant could have on the markets and the economy.

COVID-19 update

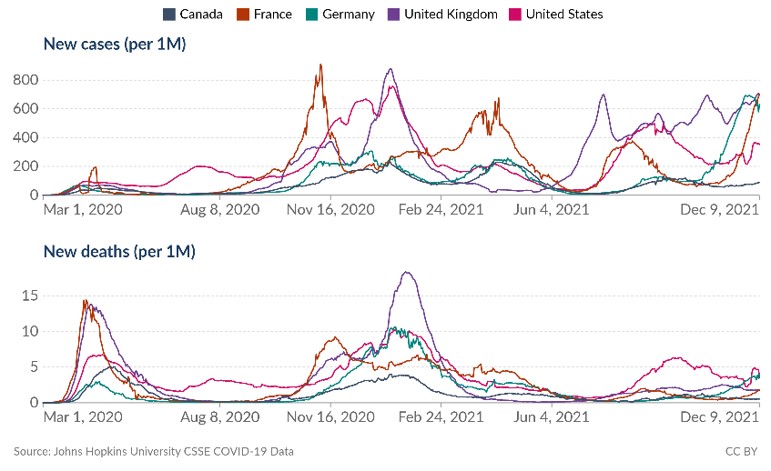

Omicron has dominated markets (and the wider world) in the past weeks. There is still much to learn about the new variant, but one thing we know is that Omicron is more transmissible than previous variants, as shown by the sharp increase in infection rates. We have not yet seen a corresponding increase in deaths, implying that Omicron, whilst more likely to spread, is not causing the same serious illness as previous variants (see Figure 1).

Figure 1. Number of new COVID cases and deaths (Source: https://ourworldindata.org/covid-cases - 10th December 2021)

As a result, Governments are once more considering lockdown measures to limit the spread of Omicron and reduce the burden on health-care systems. Given the news that two vaccines provide inadequate protection, there is a renewed push for everyone to receive a booster vaccine, to slow the spread of the variant.

Investors have reacted with concern to this news, especially as Governments are considering lockdown measures. The UK, which currently has the second highest infection rate of the new variant, has asked people to work from home where possible, and to wear masks in public places. Meanwhile, Denmark, which is experiencing a similar increase in cases, has reduced opening hours for Bars and announced the closure of schools and colleges early for Christmas.

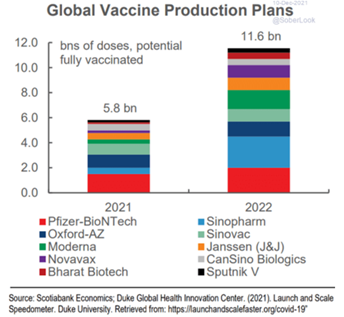

There is reason to be optimistic because Health Services now have a good understanding of COVID-19, which means that a modified vaccine can be produced quicker – Pfizer announced that an Omicron vaccine could be available as soon as March. Furthermore, vaccine production should double next year, supporting the push for people to get a booster shot (see Figure 2.)

Figure 2. Forecast of vaccine production (Source: Daily Shot – 10th December 2021)

Impact of Omicron

The impact of Omicron on investment markets and economies has been similar to what we have already seen, if on a smaller scale.

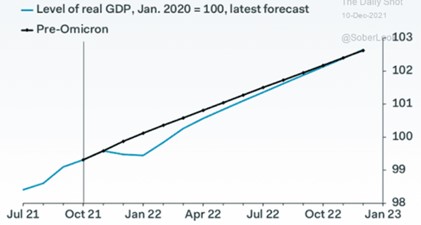

The forecast of Gross Domestic Product (GDP), which is the total value of goods produced and services provided in a country during one year, in Europe and the United Kingdom were revised downwards in anticipation of increased infection rates and lockdown measures dampening economic activity. This, however, is expected to be temporary, with the UK expecting a decline in the first quarter of the year overall, but with a recovery beginning in February, and growth returning to pre-Omicron levels by the third quarter of the year(see Figure 3a.).

Figure 3. UK GDP forecast (Source: Daily Shot – 10th December 2021)

Europe and the UK are still in the Brexit transition period, which has resulted in significant declines in trade flows, which, when combined with disruptions in the global supply chain, have been further headwinds to growth. As a result, the European Central Bank remains dovish, which means it is unlikely to raise interest rates, while the Bank of England (BoE) is expected to raise interest rates but by a smaller amount – the forecast at the beginning of November had a rate of 1.3% by April 2023, but this is now down to 1.2%.

In absolute terms, this is insignificant, but it may cause the BoE to reconsider future interest rate decisions. Earlier this week, the BoE reported that it was considering removing the requirement for prospective homeowners to show that they can afford a 3% interest rate increase on their mortgage. This would help first-time buyers (and the housing market), but also provides some insight into how the BoE sees the interest rate path developing.

United States (US)

The US has not been immune to the spread of Omicron, with infection rates rising, but the labour market is becoming increasingly tight, which means unemployment is lower – in fact November's unemployment rate was the lowest since the pandemic began.

This has prompted the Federal Reserve Chairman, Jerome Powell, (who was recently nominated for a second term) to adopt a more hawkish stance, raising the prospect of an interest rate hike sooner than expected, as well as reducing the amount of government-backed bond purchases it is making (also known as tapering), more quickly. Previously the Federal Reserve's monthly purchase of $120 billion in government-backed securities would reduce by $15 billion, but this figure could now be higher. Remember, however, that tapering does not mean tightening and that the Fed will continue to support the economy and provide liquidity to the market.

Market expectations have therefore risen, with the probability of interest rates increasing three times next year reaching 70%. This was as high as 90%, but the emergence of Omicron has raised concerns about what this will mean for the US economy and the impact of a rate increase.

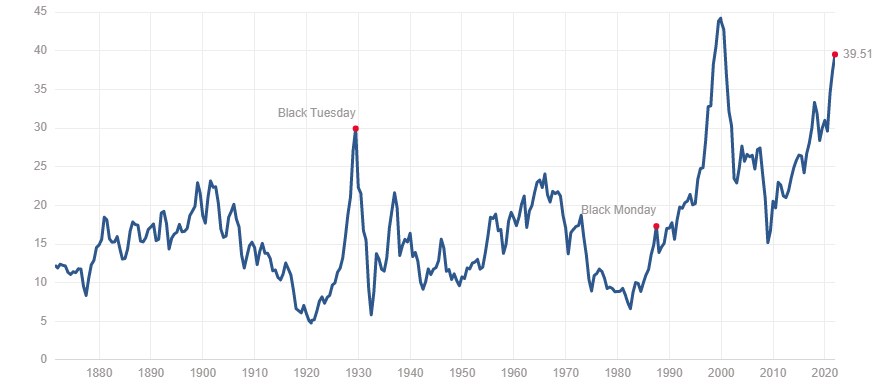

US equities continue to outperform, with the S&P 500 trading at 4,634, close to an all-time high. The S&P 500's CAPE P/E ratio has hit 38.8, the second highest reading since the 1880s (see Figure 4.) (The CAPE P/E ratio considers the 10 year average inflation adjusted earnings of a company which allows investors to assess the earnings profile of a company over an economic cycle).

Figure 4. S&P 500 CAPE P/E ratio (Source: https://www.multpl.com/shiller-pe – 10th December 2021)

This continued outperformance points to the continuation of the growth theme that has dominated markets in recent years. Interest rates are typically low in this environment, which (all else being equal) is supportive for equities and sectors such as technology (approximately 28% of the S&P 500) tend to outperform.

If the Fed tightens policy by raising interest rates, this trend may change as growth-oriented stocks are more sensitive to changes in interest rates, as they have larger future cash flows that will then discount at a higher rate. Value stocks, on the other hand, which are currently trading at comparatively low valuations, are less sensitive to changes in interest rates, and we may see a rotation from investors into these stocks, as value historically outperforms in a tightening cycle.

China

China's recovery continues, with the world's second-largest economy expected to grow at 8% this year. This is due to a higher trade surplus as exports have increased relative to imports.

This combined with the recent policy easing from the Peoples Bank of China (PBoC), where they cut the reserve requirement ratio, so the amount of money that a commercial bank must hold in liquid assets, by 0.50% and increased the liquidity in the economy, which has seen net foreign flows increase. This has seen the demand for Chinese securities increase and support for mainland stocks and Chinese bonds issuances.

Moving forward, the picture is less certain, with growth expected to increase by only 5.3%. This follows headwinds from the property sector, dealing with the fallout from the Evergrande restructuring and the implementation of "the three red line" policy, which aims to reduce leverage within the sector. The increase in trade surplus has caused the Renminbi to rise, making exports less appealing, and we may see a slowdown in exports, dampening growth.

Summary

Omicron has been an obvious setback to the Global recovery, but we continue to expect positive economic growth with activity growing, improvement in corporate balance sheets and continued support from Central Banks in the coming months.

Uncertainties remain though, with inflation running higher than expected for longer, with improvements in the labour market and continued supply chain disruption. One of the primary risks to financial assets is the risk of Central Banks making policy mistakes.

These uncertainties have created market divergences between the pandemic's winners and losers. There are those companies which are in debt and those with strong balance sheets, and there are countries that have established vaccine distributions and those that have not.

We believe that these uncertainties continue to create investment opportunities while also emphasising the importance of having a well-diversified portfolio.

Note: This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions.

Investment returns are not guaranteed, and you may get back less than originally invested; past performance is not a guide to future returns.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright