Trump's return - investment boom or inflationary timebomb?

The US election has dominated headlines and markets over the recent past, with each upwards swing in Trump’s odds driving the dollar and US government bond yields higher. Now that the US election has delivered a new President, we can consider how markets have reacted and the broader economic implications.

Trump's Consolidation of Power

It is now clear that Donald Trump and the Republicans have won a resounding victory, sweeping the Presidency, the Senate, and the House of Representatives. Additionally, the Republicans retain a majority in the Supreme Court and are expected to ‘pack the benches’ of the lower courts at the beginning of the Trump presidency. This result gives Trump almost complete control over the three arms of US government, making it likely that he will be able to push forward with his agenda relatively unimpeded.

What does the 47th President intend to do with this power? Separating rhetoric from policy can be difficult with Trump, as exaggerated rhetoric is often used as a negotiating tactic and is part of Trump’s ‘Art of the Deal’. A sense of what really matters to Trump can be gleaned from his most frequent public utterances on certain policy issues.

Key Economic Priorities Under Trump

The three most consistent issues with economic implications have been:

- Reductions in immigration and closing of the loopholes in the asylum system

- The China trade threat

- The use of tariff policy to rebalance American trade

US Equity Market Response

In recent years he has also flipped his script on the need for a balanced government budget, from a fiscal hawk in the 80s and 90s to ‘the great protector’ of social security programs in the 2024 election. Continued lavish government spending in combination with his proposed tax cuts creates inflationary pressure.

At a headline level the pursuit of these aims has two primary economic impacts, the first being upwards pressure on medium-to-long term inflation, the second being an increased incentive to bring goods manufacturing back to the US.

The inflationary aspect causes rising government bond yields (investors must be compensated for the risk of rising inflation over the period they hold a bond), which, in combination with the direct appreciation impact of tariffs and the smaller trade deficits they produce, have resulted in upwards pressure in the value of the dollar. The manufacturing onshoring aspect has been a boon to the stock prices of medium and smaller sized US companies that are more exposed to domestic US supply chains and will therefore see the most benefit from a rejuvenation in those supply chains.

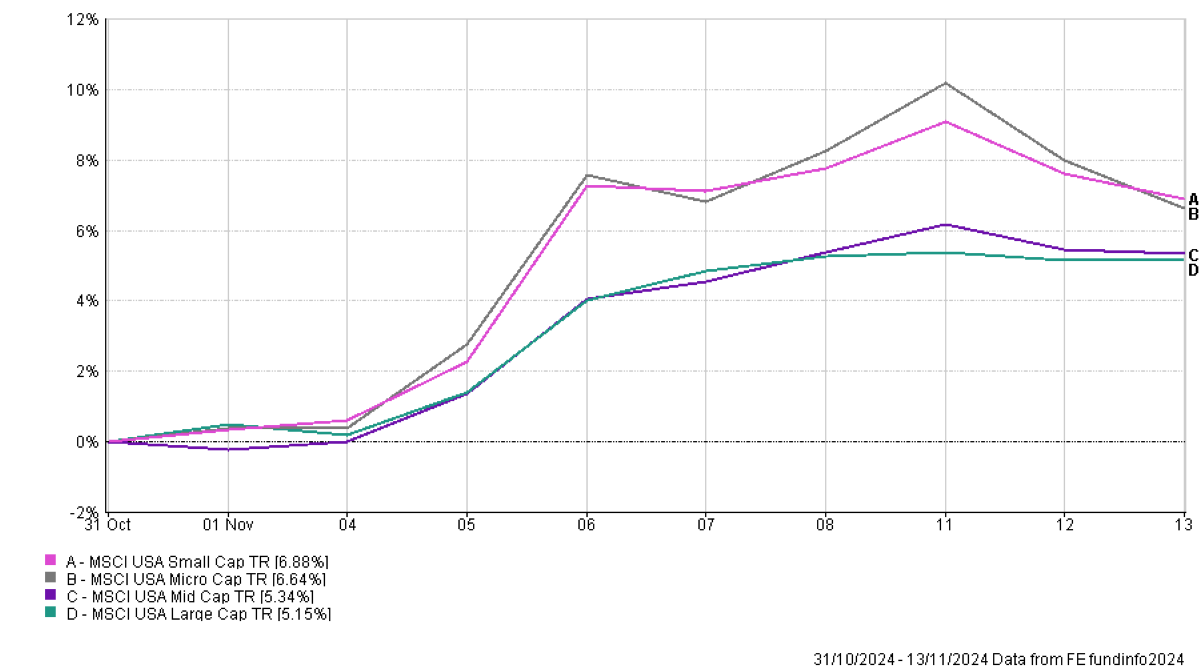

Figure 1 – US equity market returns split by market capitalization – Source: FE Analytics, 2024.

Once Trump’s election victory became clear to markets on the 6th of November there was a rapid surge in US equity prices. Smaller companies, which have lagged their larger counterparts over recent years, surged ahead of the wider market.

Small companies, at least conceptually, are set to benefit in multiple ways:

- Trump has consistently pushed for the Federal Reserve to lower interest rates and small companies are more dependent on borrowing, so more responsive to lower rates;

- Onshoring of manufacturing should benefit the companies most exposed to domestic US supply chains, as smaller companies are;

- Deregulation is likely to benefit smaller companies, as the costs of regulation are more easily borne by the largest companies and so create barriers to market entry for small firms.

Global Equity Market Trends

Casting our net a little wider into the global equity ponds we can get a feeling for how investors expect the Trump regime to impact the key trading partners of the US.

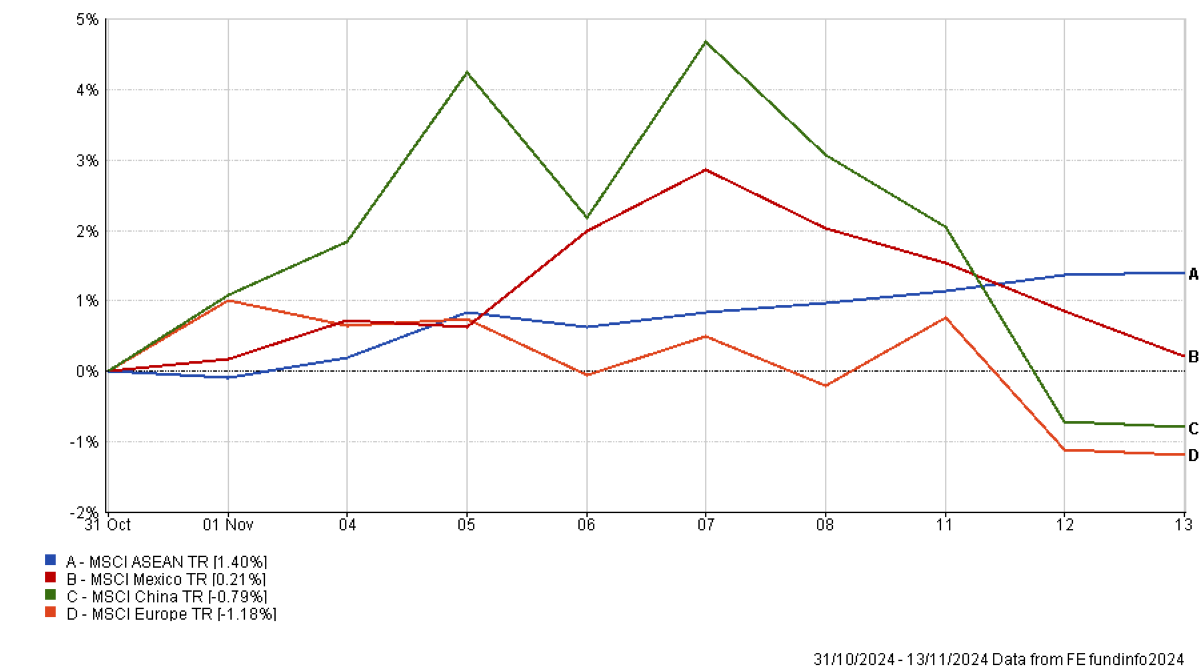

Figure 2 – Regional equity market returns for key US trade partners – Source: FE Analytics, 2024.

Starting with the clearest loser of the situation, Europe. With an increasingly domineering US to the west, growing China to the east and a deindustrialising Germany at the centre the EU is facing pressures last seen during the 2012 Euro crisis, although arguably more existential. Sentiment towards the European economy and equity market was weak to start with and Trump’s election has only reinforced this.

The reaction in Chinese equity markets has been more mixed, but ended in pessimism. On election day equities fell as the prospect of a full blown trade war rose, the day after election equities rose on the narrative of a ‘grand bargain’ between the US and China – a deal that only Trump “the dealmaker” could make unimpeded by the Democrat’s ideological red-lines over human rights and the Chinese system of government. This optimism soon petered out and Chinese equities fell from the 8th onwards.

Where the reaction has been far more positive is in countries that have been the biggest beneficiaries of the shift in trade patterns away from direct ‘China to US’ trade to indirect ‘China to intermediary country to US’ trade. The Association of South East Asian Nations (ASEAN) and Mexico have benefitted a great deal from this so far and markets expect this trend to continue.

Fixed Income Market Response

Finally, we’ll take a look at the response of the fixed income markets. Since September, when Trump’s victory probability began to rise, so did government bond yields as markets began to price in the potential inflationary impact of Trump’s policy mix, meaning that by election day much had already been priced in. Even so, there was a spike in the 10-year US government bond yield, a fall in yields from the 7th-11th and then a rise back to the election day levels – investors remain concerned with Trump’s inflationary impact.

Conclusion

So, where does that leave us in terms of portfolio allocations? While at first sight Trump’s tariff policy seems set to benefit US firms at the expense of non-US firms, the positive equity market response in Mexico and ASEAN show that it still pays to hold a portfolio that is diversified across multiple regions – in the event that one region is negatively impacted this can be balanced by positive impacts to other regions. Additionally, it has paid, and is likely to continue to pay, to diversify US equity allocations out from the largest companies in the S&P 500 – to that end our Managed portfolios maintain a direct allocation to mid and smaller sized US companies.

Investment Champion uses the expertise of the Investment Team at The Private Office to create simple to understand investment portfolios that offer an alternative and cost-effective way to make your money grow. The Investment Champion portfolios provide diversified investment exposure across a range of geographies and asset classes in order to produce attractive risk-adjusted returns for investors. These portfolios use passive funds which track the performance of a benchmark and are not actively managed by a fund manager. They therefore offer a cost-effective solution to building a portfolio.

The information in this article is correct as at 15/11/2024.

This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Investment returns are not guaranteed, and you may get back less than originally invested; past performance is not a guide to future returns.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright