Around the world in 90 days - Global investment trends in Quarter 3 2023

For our Investment markets update and analysis this month, we’ve taken the opportunity to take a step back and look at what factors have been influencing global markets in Quarter 3 2023 and the likely impact on underlying investments.

As the rise in inflation and global interest rates looks to be reaching a peak, we’ll look around the globe to see what other data is telling us about the direction of value and of course, what our plans will be in response. With continued geo-political uncertainty in Europe and now in the Middle East too, it's never been more important to keep a close watch on what is happening to asset values and trends.

Global Markets

US

‘Higher for longer’ interest rates have been the primary driver in US markets in Quarter 3 2023. Both bonds and equities have been negatively impacted, with the S&P 500 down around 4% through the quarter and long-term bond yields rising to the highest levels in 16 years. Bond prices are inverse to their yield, so as bond yields rise their price falls.

The main factors pushing up bond yields have been the ‘higher for longer’ interest rate stance of the Federal Reserve, along with fears of an excess supply of bonds due to large US government budget deficits.

Rising bond yields increased the discount rate applied to equities – as the future cashflows of companies are discounted back to present value at a higher interest rate, their present value declines, putting negative pressure on equity values.

On a sector basis in the US, energy stocks have been a winner, with rising oil prices pushing up their share prices. Oil prices have seen a resurgence due to supply cut announcements by Saudi Arabia and Russia, along with better-than-expected oil demand from China.

Europe & the UK

European assets have come under similar pressure to those in the US, with the European Central Bank (ECB) also emphasising that interest rates will be higher for longer. European equities posted similar returns to those in the US, falling around 3% through the quarter. European bond yields also rose through the quarter, but to a lesser extent than in the US – the European economy is weaker than the US so there’s a higher expectation of near-term recession and the associated interest rate cuts. As interest rates have risen slower in Europe it has decreased the attractiveness of European fixed income relative to the US, causing capital to flow from Europe to the US, thus putting negative pressure on the Euro against the Dollar.

European equities derive over 60% of their sales abroad, with this figure increasing among larger international companies. As a result, there have been lower returns for smaller companies with greater exposure to the slowing European economy. Larger firms with more geographically diversified earnings have therefore performed better through the quarter than smaller companies.

UK equities have had a better quarter than European and US peers, with the FTSE 100 ending the quarter up around 2%. UK equities had broadly followed their European counterparts until mid-September when better-than-expected Chinese economic data reignited oil prices. Energy & commodity stocks have a much higher weighting in UK markets than in Europe, so rises in oil prices tend to pull the index up.

Asia & Emerging Markets

Chinese capital markets remain depressed, with sentiment low after a disappointing opening up from Zero-Covid policies. The expected ‘big bang’ of growth is yet to materialise, resulting in dismal investor sentiment and poor returns across equity market sectors, with the property sector seeing acute pain. Despite signs of improvement in economic data in the August and September releases, equity markets remain unconvinced and have failed to pick back up. Chinese equities are the largest component of Emerging Market (EM) indices, resulting in the EM indices posting poor returns through the quarter. Additionally, many emerging market economies are highly linked to China, so economic doldrums in China tend to hold back earnings across emerging markets.

This is in stark contrast to Japan, where returns have been strong in local currency terms (a depreciating Yen, however, has erased some of those returns to international investors, particularly Dollar denominated investors). Japan has benefitted from robust GDP and wage growth, as well as renewed interest from international investors who are attracted by cheap valuations and greater emphasis on shareholder value in corporate management culture. Value stocks derive most of their valuation from current activities rather than the promise of future growth. In Japan, the value stocks are undervalued and this quarter they made up some of this lost ground on growth companies, as Japan has telegraphed incremental monetary tightening from their ultra-loose stance.

Macroeconomic Outlook

US

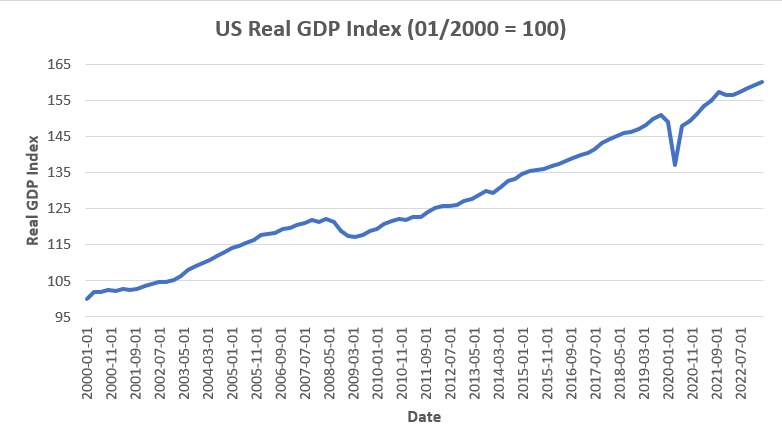

Although we should always remain cautious and diligent in assessing risks, the outlook for the US looks positive, especially when compared with Europe. GDP growth so far this year has been strong, and real-time gauges of growth like the Atlanta Federal Reserve’s GDPNow point to annualised growth of around 5% in the third quarter. The New York Fed’s model points to a figure closer to 2.5%, but even that is above the trend of the last 10 years. The chart below shows the historic trend for Real GDP growth in the US.

Figure 1. Real GDP growth index for USA (Source: U.S. Bureau of Economic Analysis, 2023)

Inflation has also been on a consistent downwards path towards the Federal Reserve’s 2% target, easing the pressure on the Fed to aggressively hike rates further. The most important factors sustaining US economic strength are: strong consumer spending supported by a strong labour market and excess savings from pandemic assistance schemes. We can expect excess savings to dwindle over time, and by some measures those savings have run out for the lowest income Americans, so consumer spending may start to recede over coming quarters. That being said, the large fiscal spending we have seen recently is unlikely to change in the near term, with Inflation Reduction Act spending commitments extending until 2031, thus providing an ongoing tailwind for economic growth.

Europe & the UK

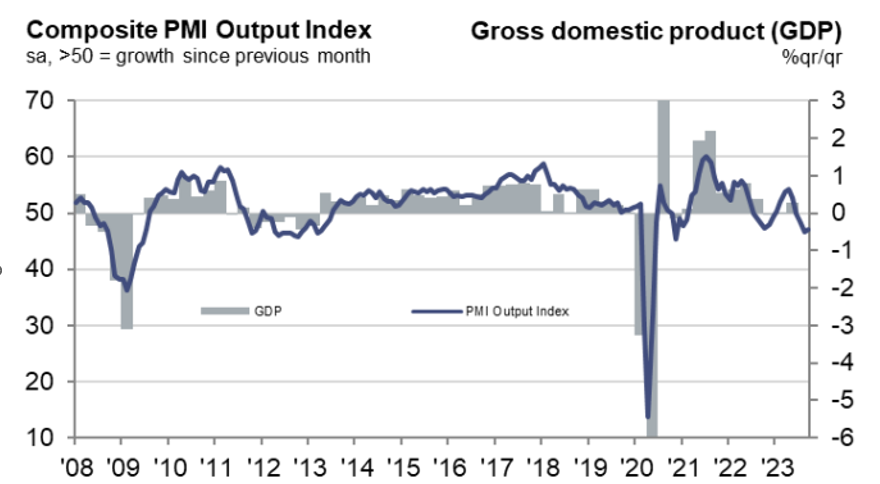

The picture in Europe and the UK is not as rosy as the US, with European economies still suffering from the fallout of the Russia-Ukraine war and the impacts of dependency on imported natural gas. European malaise is concentrated in Germany, and more specifically in German heavy industry. The readings of the Purchasing Managers Index (PMI) created by surveying management in large businesses, have consistently pointed to steep contractions in German industrial activity, even as peripheral nations like Greece have seen relatively healthy readings (see Figure 2 below). European industry had been leveraged to cheap natural gas from Russia, so as that input rose in cost dramatically it has handicapped international cost competitiveness and thus activity.

The pessimistic view from European wide Purchasing Managers can be seen in the Composite Purchasing Managers Index chart below:

Figure 2. European Composite Purchasing Managers Index (PMI), Source: PMI by SPGlobal, 2023

Backward looking measures of Eurozone GDP have been flat since the pandemic, however forward-looking measures such as the Purchasing Managers Index point to a likely recession in the near future – markets are currently pricing in interest rate cuts early next year and for the ECB to provide 2-3 cuts. The Eurozone is a collection of many countries and there are some positive elements, such as Ireland that is experiencing a services sector boom associated with its lenient taxation policies on multinational firms. Encouragingly, European inflation is also returning back to the ECB’s 2% target, with producer prices and import prices both declining and the labour market cooling off. Although year-on-year inflation remains elevated, at 4.3% the readings over the last 3 months have been running at a rate of 2.4%.

The UK is in a similar position with regards to economic growth, with GDP around the levels achieved before the pandemic but no signs of strong growth. Forward looking measures also point to a slowdown in activity in coming months. Where the UK and Europe diverge is when looking at inflation. UK producer prices have not seen the same decline that European prices have, and importantly wage growth remains very elevated at 7.8%, a figure that is inconsistent with the Bank of England (BoE) target inflation rate of 2%. As a result of more entrenched inflation, markets are pricing in BoE interest rate cuts towards the end of Q1 2024 and are only pricing in 1 interest rate cut.

Asia & Emerging Markets

The outlook in Asia and Emerging Markets, particularly China and China-linked economies, is more mixed. Chinese economic performance has been sluggish since reopening from Zero-Covid, as a deflating property sector drags on performance, threatening to tip the economy into deflation. The most recent economic data releases, however, point to improvements in performance as industrial production and retail sales bounced back and inflation turned marginally positive, indicating deflation may have been avoided. To gain confidence in China’s economy we will need additional data points that suggest a trend is forming, but the most recent data is encouraging. On the property front, while the government is clearly cautious of reigniting a bubble, there have been steps to introduce targeted support to ensure completion of projects under construction and support first-time buyers. There has also been some steps towards stimulus, with local government infrastructure projects being fast tracked, however this is not to the same extent as the stimulus ‘bazooka’ that was employed after the Global Financial Crisis in 2008. Overall, the outlook for China will depend on the balance between the negative effects of a weak property sector and the growth-inducing effects of further rounds of stimulus.

Given the importance of China to emerging market economies (China is the #1 trade partner of the vast majority of emerging markets) the economic performance of many emerging markets will depend on how durable this bounce back in Chinese economic performance is.

The outlook for Japan, on the other hand, is more positive. Having suffered 30 years battling weak domestic demand and the accompanied deflation, Japan is entering a virtuous cycle of positive inflation leading to demands for growing wages, which support growing domestic demand, which keeps inflation positive, and so on. While the outlook is positive, risks remain, as if China’s economy stumbles it will hit Japanese firms that sell into the large Chinese market.

What does this all mean for portfolios in the near term?

We see a world where overall economic growth is slowing and the benefit of extra savings and stimulus in the US economy has masked some weaknesses. As those savings are spent we will eventually reach a point where the true level of output will become apparent. Whilst we expect a slowdown and perhaps even a shallow recession, the fact that inflation is already falling should lead to a peak in interest rates and, in time, the prospect of rate cuts.

We aim to keep the risks within our portfolios suitably diversified so that we can benefit where we see opportunities whilst helping to protect portfolios should conditions change.

Note: This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Additionally, past performance is not a guide to future returns. Investment returns are not guaranteed, and you may get back less than you originally invested.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright