Market Horizon: Smooth Sailing or Rough Waters?

In last month’s Investment Market Update we spoke about the market volatility seen in early August, caused by a sharp decrease in risk-taking due to the combination of:

An abrupt change to Japanese monetary policy,

The release of weak US labour market data, and

Concerns over the ability of large tech firms to turn AI investments into bottom-line profits

Since then, global equity markets have broadly recovered, although worries remain over both the health of the US labour market going forward and the ability of the largest technology companies to deliver on the promised profits of their AI investments. These worries have resulted in a minor selloff of tech stocks at the start of September, flattening global equity returns.

For September’s investment market update we will take a closer look at the recovery in markets and the previously mentioned faccors causing ongoing concern amongst investors.

Market Recovery

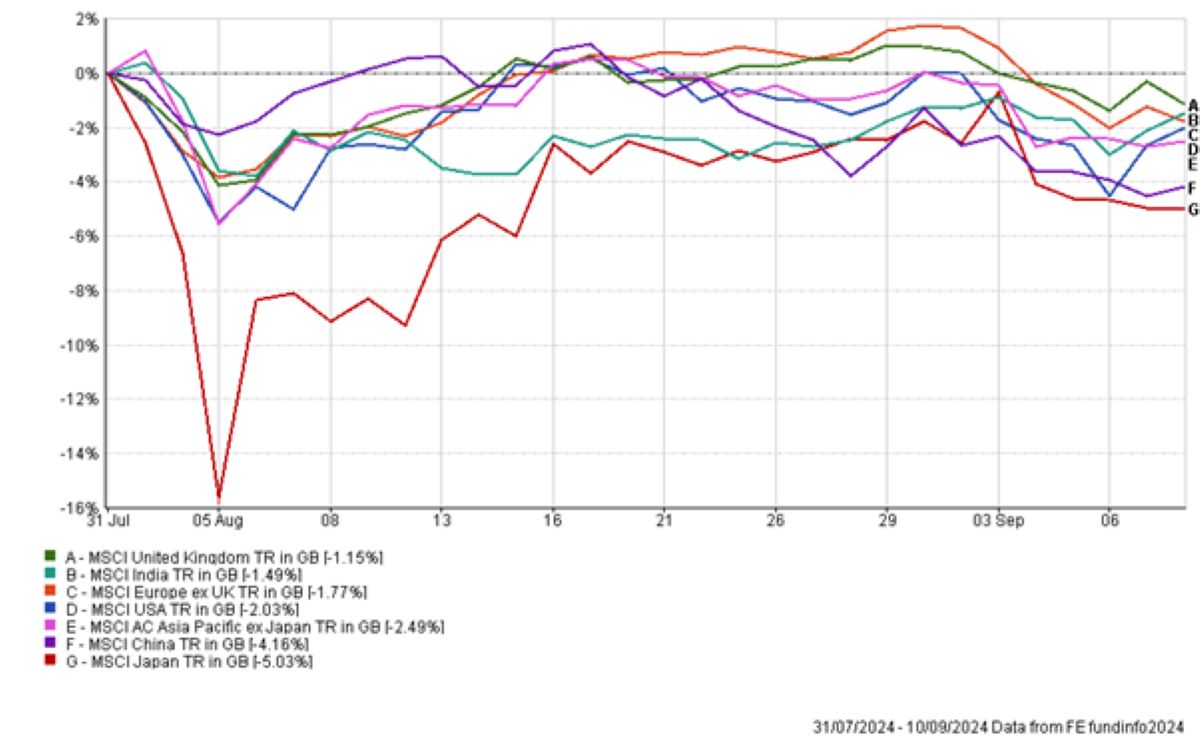

Figure 1 – Returns of major regional equity indices from August to early September – Source: FE Analytics, 2024.

Figure 1 shows the returns of major regional equity markets to a sterling denominated investor from August through to early September. The major bout of volatility, hitting Japanese equities the hardest, can be seen in the first week of August – for an explanation of the factors causing this please read last month’s market update, available here. Markets recovered through August, as investors came to the conclusion that the moves in early August were an overreaction. Market volatility reduced and the hardest hit regional markets and sectors/industries saw the swiftest recovery. This meant a strong rebound in Japanese equities and large technology companies.

The beginning of another, hopefully smaller, selloff

What we also see in Figure 1 is the beginning of another selloff in equity markets at the start of September. While this has not been nearly as violent as the August selloff, it has nonetheless pulled many regional indices down close to their levels seen in August. The background causes remain similar to last time, excluding the Japanese monetary policy factor – primarily concerns over a weakening US labour market and the high stock prices of US tech firms relative to the profits they are currently delivering from their AI investments.

So, what are the US labour market concerns? These concerns stem from slowing job creation and a rising unemployment rate. The most recent market-moving data releases were the reports on job openings and new job creation, both of which are down significantly versus a year ago, or even a few months ago. Whilst neither measure is at the level indicating a recession, the direction of travel indicates a slowing economy. You can be fairly sure a recession is signposted when total employment declines outright from month-to-month. The most recent data showed 142,000 jobs added in August 2024, so no recession, but down significantly from the 210,000 jobs added in August of 2023 and below the roughly 200,000 jobs needed to keep up with population growth.

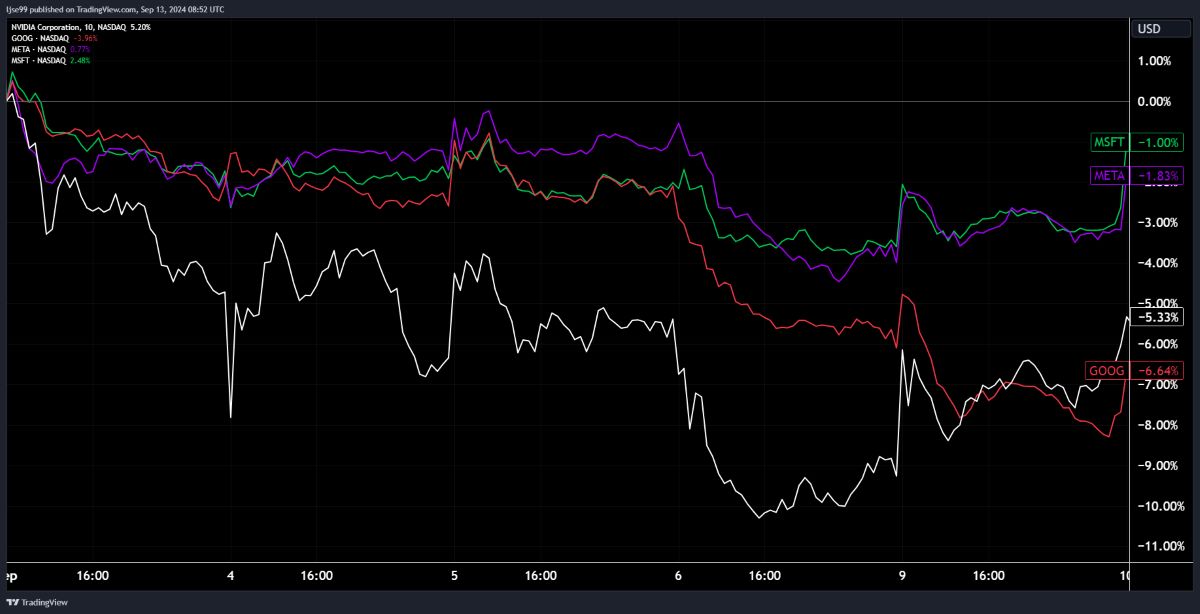

Figure 2 – Returns of prominent AI-related technology stocks over the start of September – Source: TradingView, 2024.

Figure 2 shows the returns of the most prominent AI-related technology companies in early September. Nvidia, the most linked to AI, fell as much as 11% by 06/09/24 but has since recovered around 6% of that drop. Similarly, Google (Alphabet) is down over 7% so far this month.

But what has caused this selloff? Outside of the general risk-averse sentiment caused by weakening labour market data, investors are becoming increasingly sceptical of tech firms ability to turn their large AI investments into near-term profits. Whilst AI models like ChatGPT have wowed us with their innovation, they have not yet found sufficient commercial uses to generate revenues that cover the costs of building out vast data centres and research teams. Despite this, tech firms steam ahead, with Mark Zuckerberg commenting in a recent interview that they must continue to invest heavily in AI for fear of falling behind others and becoming ‘irrelevant’ in years to come.

This sentiment came to a head upon the release on Nvidia’s most recent quarterly earnings report, along with the forward guidance for the next quarter that comes with it. While Nvidia recorded substantial revenue growth from the first to the second quarter, growing in one quarter what the average company would be envious of growing in a whole year, their forward guidance pointed to slowing revenue growth in coming quarters. They cited issues with the production of their next generation Blackwell chips. While revenues are expected to continue growing, the expectation of just a slowing of that rate of growth rattled markets because of the very steep growth assumption baked into Nvidia’s high share price. Markets have reacted to this and applied the sentiment to other AI-related stocks, along with research suggesting Microsoft may only be bringing in profits in the single digit billions from their ownership of OpenAI (the creator of ChatGPT), a drop in the bucket for a firm generating profits of $72bn in 2023. AI-related stocks have therefore seen the price declines shown in Figure 2.

What next?

Given the importance that markets have recently attached to US labour market data, the next month’s figures will be pivotal to market narratives, meaning another month of weak job growth will confirm a slowdown and could lead to further equity market volatility. Conversely, more positive figures should push investors back to the ‘soft landing’ camp.

Additionally, politics will continue to be an important factor. Kier Starmer’s first Budget will be unveiled on October 30th and the US election will take place 6 days later on November 5th. While the former is unlikely to surprise capital markets – save for some speculation about removal of the inheritance tax breaks given to investors in the London AIM equity market – there is far more uncertainty surrounding the latter, with neither US presidential candidate having fully fleshed out their economic policies, leaving a wide range of policy uncertainty for investors to navigate.

Investment Champion uses the expertise of the Investment Team at The Private Office to create simple to understand investment portfolios that offer an alternative and cost-effective way to make your money grow. The Investment Champion portfolios provide diversified investment exposure across a range of geographies and asset classes in order to produce attractive risk-adjusted returns for investors. These portfolios use passive funds which track the performance of a benchmark and are not actively managed by a fund manager. They therefore offer a cost-effective solution to building a portfolio.

The information in this article is correct as of 12/09/2024.

This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Investment returns are not guaranteed, and you may get back less than originally invested; past performance is not a guide to future returns.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright