When will central banks come off the gas?

As central banks contemplate the future health of the World economy there is one word on investors' minds in recent weeks and that is ‘tapering’.

Tapering refers to when a central bank slows down the amount of bonds it is purchasing. The purchase of bonds forms part of Quantitative Easing and whilst being a staple of central bank policy since the global financial crisis this has taken on a new form in the aftermath of the pandemic.

As the world’s largest economy, we have focussed on how the United States is approaching the prospect of tapering.

Since July 2020 the US’s Federal Reserve have been buying $80bn of Treasury bonds and $40bn of Agency Mortgage-Backed Securities (MBS) per month - this also coincided with the decrease in its policy rate (equivalent to the UK base rate) from 1.5% to a range of 0-0.25%.

By doing this the Federal Reserve has compressed bond yields and lowered the rate which consumers pay on mortgages and loans which in turn has spurred economic activity by freeing up income.

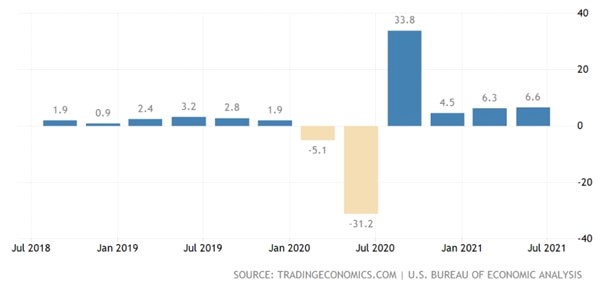

We saw US GDP falling approximately 31% in the second quarter of 2020 as the pandemic caused millions to stop working and for the economy to come to a standstill, but fast forward to the present and with the recent figures coming in at 6.3% growth for the first three months of 2021, this means the country is back to levels not seen since 2019 (see Figure 1.)

Figure 1: US GDP quarterly growth rate (%)

This material improvement in GDP is one of the reasons some cite that the Federal Reserve can now slow down its accommodative measures without impairing the economy.

Another factor to be considered is inflation. Inflation has risen to 5.3% in the US which is the highest value recorded since 2008 and well above the Federal Reserve’s target of 2%. This means that prices are generally rising in the economy and the Federal Reserve will want to curtail any prolonged inflation because this can lead to lower consumer demand and in turn lower economic growth.

The argument is more nuanced however as inflation is driven by both supply and demand factors. Supply factors (or “cost push inflation”) consider the cost of capital, labour and land, whereas demand driven inflation is where consumer and business demand are in excess of production, driving up prices.

When inflation is rising central banks ideally want it to be demand driven as that shows an economy is running strongly, however; the pandemic caused significant disruptions to supply chains and the labour force. This means we are currently seeing prices rise without the longer-term improvement in the economy. This is causing debate amongst policy makers as some argue that we need to see factors such as the pandemic and the impact of Hurricane Ida abate, to be able to truly assess the health of the economy.

Our in-house specialist investment team at TPO believes that the Federal Reserve will be cautious in any tapering action. The Chairman of the Federal Reserve, Jerome Powell, has been cautious in his rhetoric and has provided the markets with transparency on how the Federal Reserve sees the relative strength of the economy developing and how any tapering action would be implemented. This has allowed the market and investors to price in these events. He has also said that if tapering is implemented and then the US economy begins to slow down or deteriorate, he will stop the tapering policy and reassume support of the economy.

In terms of interest rates, policy makers have taken a more hawkish tone in recent times, which means a more aggressive stance, and the consensus is that policy rates are likely to stay lower for longer. Most now expect them to rise to just 0.50-0.75% by the end of 2023 – this would also likely be executed in small 0.25% increments - which again allows for the market and investors to consider the news and avoid any surprises.

Markets around the world this month

UK

The UK lifted the last domestic COVID-19 restrictions in August.

August’s Purchasing Managers’ Indices (PMIs) suggest that the UK may be past the peak rate of growth. While a PMI of above 50 indicates that market conditions are improving, manufacturing remaining steady in August at 60.1 while services softened slightly to 55.5. That said, with the strength of the domestic reopening, the FTSE All Share delivered returns of 2.7% over August and the FTSE 250 returned 5.3% over the month.

UK employment data was strong: the economy added 95,000 jobs in June. UK inflation slowed in July to 2.0% year on year, although it has subsequently jumped up to 3.2% for August. We’ll review what this might mean in next month’s Market Update.

US

August economic data confirms concerns that US inflationary pressures continue to build.

August’s PMIs showed at 61.2 and 55.4 for manufacturing and services, respectively, and the US consumer price index (CPI) delivered 5.4% year over year, to stay at decade highs. July jobs report added 943,000 jobs and saw wages rise by 0.4% month over month.

The Senate passed a bipartisan infrastructure bill that contains $550 billion of new spending over five years, for transportation, broadband and utilities.

EU

Having started its reopening later, Europe is lagging slightly behind the US and the UK on the road to normalisation.

Economic data was strong with August’s PMIs showing 61.5 for manufacturing and 59.5 for services. Year-on-year the Consumer Prices Index (CPI) is estimated at 2.7%. Annual inflation in the Eurozone was estimated at 3.0% in August, up from 2.2% in July. The spread of the Delta variant has caused cases in Europe to rise rapidly, denting consumer confidence, which fell in August. That said, Europe has now vaccinated over 70% of the population and hospitalisation rates have remained much lower than in previous waves.

Japan

Japanese shares made gains in August, despite growing worries over COVID-19. Although the mortality rate remains low, there are growing concerns over hospital capacity. Public criticism of the Government’s response has therefore ratcheted up again, and the approval rating of Prime Minister Suga and his cabinet has declined rapidly.

Attitude towards equities was impacted in August by the announcement from Toyota Motor of production cuts over the next two months. This is mainly due to the global shortage of semiconductors.

China and Emerging Markets

Investor sentiment has been boosted as the global economic recovery gathers momentum. Thailand was the best performing index market in August as Covid-19 infection rates declined and the government announced the reopening of restaurants and shopping malls.

Chinese equities were flat overall in August amid concerns over increased regulation. Meanwhile, official data showed factory activity grew at a slower pace in the month, suggesting a slowdown in China’s economy.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright