It’s East vs. West in the investment world

As well as the usual roundup of the global investment markets, this month’s update also focuses on some key investment themes that emerged in July, some a continuation from recent months, but within certain areas, in particular China and Asia, there was a marked divergence in fortunes.

Firstly, the United States (US) where Earnings Growth has continued to impress

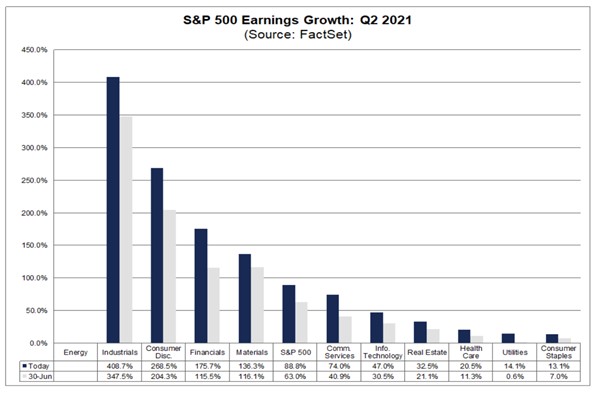

The second quarter of the US earnings season has seen a large number of publicly traded companies quarterly earnings figures showing stellar results which is turn has buoyed developed market equities momentum. Year-on-year earnings growth looks set to come in at close to 90%* versus initial estimates of 64%. This growth has been broadly spread across all market sectors, as can be seen in this chart:

Fig. 1: S&P 500 Earnings Growth: Q2 2021 (Source: FactSet)

Revenue growth, so the increase in the companies sales for the quarter is lower, but no less impressive at 24.7% year-on-year. With 11% of S&P 500 companies (so the US’s largest 500 companies) yet to report, if their results are similar to what we’ve already seen, this would represent the best three month period since 2008.

Estimates for the second half of the year are lower, but still with double digit earnings growth. The “opening up” effect will slow, but US analysts are issuing more recommendations for shares to buy, than at any other time in the last 18 years, so optimism abounds.

Not all equity markets are so richly valued so the US is a key driver. However, there is no room for disappointment, so the US needs these growth figures to come to fruition.

Next, inflation, input costs, supply chains and the debt markets

The yield on Government debt (a type of investment often referred to as gilts) has fluctuated so far this year driven by hopes and fears (economic growth, inflation, a rapidly re-opening world and the Delta variant of COVID being the key drivers). When you buy a gilt, you are effectively lending money to the Government and for that they will offer an income – known as a coupon when the gilt is initially issued. The yield of a gilt is calculated by dividing the coupon by the price paid if you were to buy the gilt at any given time. And if the price of buying a gilt after it’s been issued rises, the yield falls and vice versa. More recently yields have fallen (and prices have risen) in spite of rising inflation. This means that yields when adjusted for inflation are negative and falling.

Worldwide vaccination rates lag the UK and hospitalisations may be down but the ability of the pandemic to disrupt normality still lurks, as rising inflation illustrates.

Concerns arise if Central Banks remove economic stimulus too early or embark on interest rate increases when the market thinks the economy is not strong enough. Here we think that the authorities will hold their nerve. The Bank of England expect the hump in inflation to be temporary, a natural result of reopening. The supply chains of goods and services, which have been disrupted due to a number of factors such as a shortage of raw materials, unfinished goods and a lack of labour, will eventually adapt so that these components for production are available without this shortage.

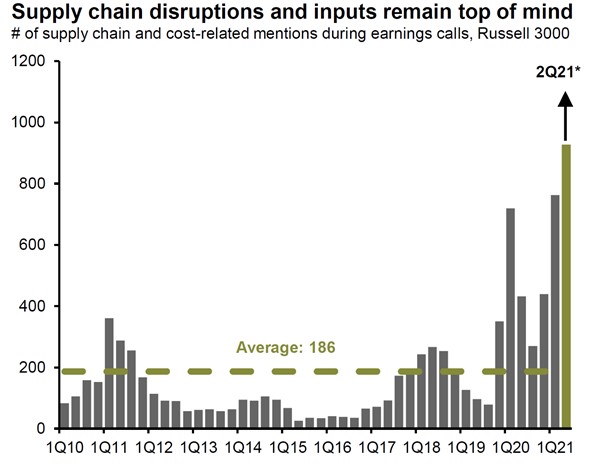

As a result, at present input costs are rising rapidly and this is unsettling many companies. The chart below which shows the number of times the supply chain was mentioned in quarterly earnings reports by Russell 3000 Companies in the US.

Fig. 2: The number of supply chain and cost-related mentions during earnings calls, (Source: Russell 3000)

Some finished goods are not available because production cannot be completed. For example, the shortage of semi-conductors and the impact this has on new car production. Limited supply pushes up the price of new cars and also the price of substitutes, in this case second-hand cars. If input price inflation causes less consumption, then that is not good for company earnings. In such an uncertain environment, it is not surprising that the demand for index-linked debt (linked to inflation) has risen markedly in 2021, as the chart below from the FT illustrates. In July, UK index linked securities were the best performing asset class, rising by 6.5%.

Fig. 3: Inflation-linked bond ETPs, monthly flows ($bn) (Sources: BlackRock, IHS Markit)

China - the dragon breathes

Chinese equities fell by around 13% in July and dragged down the equities of Asia and the Emerging Markets.

This is as a result of a long-standing drive by the Chinese authorities to influence market behaviour and social and cultural outcomes. Chinese technology giants once seemed untouchable, with billions of profits gained through aggressive expansion. That status is now more uncertain after a year of Beijing’s sweeping regulatory crackdowns that have spread like wildfire across sectors.

The Chinese anti-monopoly regulator fining Alibaba (a huge Chinese technology company) and the People’s Daily in China calling online gaming ‘spiritual opium’ are two in the latest developments in a string of measures that began in October last year when Jack Ma, the billionaire chief executive and major shareholder in Alibaba, criticised the Chinese competition authorities. Ma has not posted on social media and has rarely been seen in public since. A strong message being sent to the ever more powerful group of wealthy individuals that control China’s largest technology companies. Chinese authorities have also changed the structure of the education sector saying it is a social issue as ordinary people cannot afford ever rising fees. This collapsed the share prices of a number of companies in which foreign investors had a significant shareholding. These actions raise valid questions around Chinese state governance and western investment. The Chinese authorities are without doubt different from what we are used to in the West.

Global Markets summary

UK

In July, the UK lifted most of its remaining COVID-19 restrictions. Equities rose in July despite a volatile first few weeks due to fears of the rapidly spreading Delta variant.

The outlook for further growth remains strong, but with businesses struggling to fill job vacancies and shortages of raw materials starting to bite, business costs rose at the fastest pace on record in July. However, Purchasing Managers’ Indices (PMIs) showed clear signs that supply bottlenecks are putting a ceiling on activity levels. The PMIs are economic indicators that suggest whether market conditions are improving or not.

The UK Consumer Price Index (CPI) shows that inflation increased by 2.5% in the 12 months to June, up from 2.10% in May.

US

US equity and bond markets contrasted greatly in July as the S&P 500 hit new all-time highs while US Treasury (similar to UK gilts) yields slumped to lows last seen in February. Demand for US Treasury has been unusually strong due to a combination of Fed purchases, institutional investors looking to rebalance following a strong period of equity gains and elevated cash balances across the private sector. As mentioned earlier, company earnings for the second quarter of 2021 (Q2)emerged as the most influential factor. The proportion of US Companies beating earnings estimates for Q2 is currently running far ahead of the five-year average.

Eurozone

Eurozone equities also saw gains in July. Top performing sectors included information technology, real estate and materials. The energy sector was the main laggard. Purchasing managers’ index (PMI) data offered encouragement that the Eurozone recovery was gathering pace last month. Business activity grew at its fastest rate in 21 years, with a robust improvement in service sector activity more than offsetting a modest decline in the manufacturing PMI that was linked to the disruption in the supply chain. Eurostat data showed Eurozone Gross Domestic Production (GDP), which is a measure of the size and health of a country’s economy, grew by 2.2% in Q2, after a 0.3% decline in the first three months of the year, while annual inflation ticked up to 2.2% in July versus 1.9% in June.

Japan

The Japanese stock market ended July at the bottom of its recent range, recording a loss of 2.2% for the month. There was also concern domestically as COVID-19 infections picked up towards 10,000 per day nationwide. Opposition towards the Government’s approach has been rising and public approval for the Suga cabinet, the current Government of Japan, fell to just 33%. Near-term prospects for the full recovery of the domestic economy are dependent on the continued success of vaccine roll-out.

China and Emerging Markets

Emerging market equities continued to lag developed market peers in July. Weakness in Chinese stock markets particularly notable; reforms to the private tutoring sector triggered volatility towards the end of the month. As a result, China was the worst-performing index market in July, recording a decline of 13.4%. The Philippines and Thailand both lagged the MSCI Emerging Markets (EM) Index as daily new cases of COVID-19 increased; the share of the population fully vaccinated is sub 10% in both countries.

Please note: This market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Investment returns are not guaranteed, and you may get back less than originally invested: past performance is not a guide to future returns.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright