Will 2024 see another recession?

The economy faces potential risks of a recession in 2024, indicated by negative trends, reduced investment in real estate and non-residential sectors, and potential weaknesses in global trade and labour market conditions.

Core inflation has remained above the US Federal Reserve's target, prompting a more hawkish stance and increased attention to tackling inflationary pressures - so we can expect more interest rate rises. The market's response to this is reflected in rising US bond yields, while the NASDAQ 100 continues to climb, driven by the AI revolution and increased retail investor participation. However, the labour market is strong, evident through robust job creation and low unemployment claims.

Looking Back: 2023 Market Roundup

We take a look back at market activity from the last six months, to help form future predictions in the economy.

Labour Market Strength and Inflation

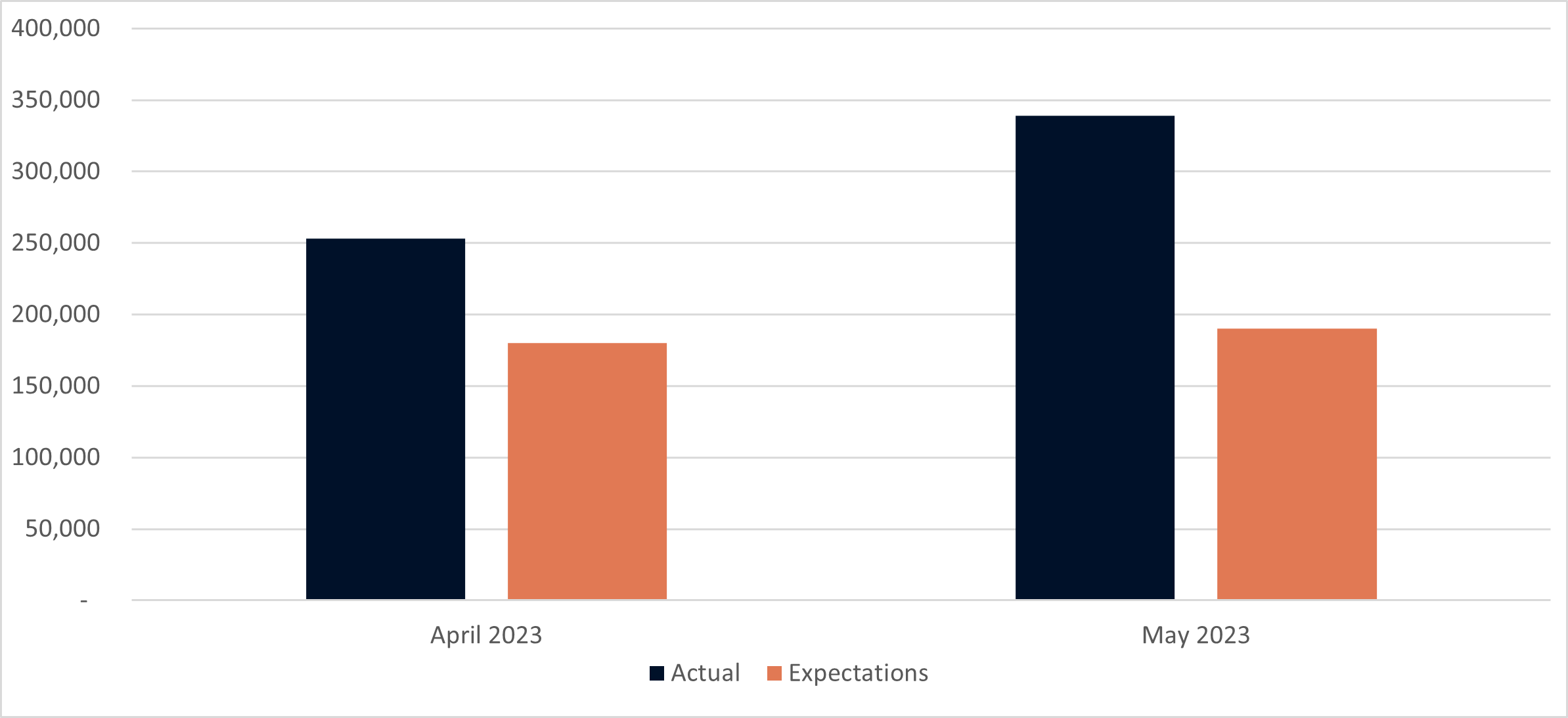

The labour market is a key indicator of economic health. A robust labour market implies sustainable employment, allowing the Federal Reserve to focus more on controlling inflation. Recent data shows that US job creation (nonfarm payrolls - which represents roughly 80 percent of all workers who contribute to gross domestic product (GDP) exceeded expectations in April and May, signalling strength in job creation. Additionally, unemployment claims remain relatively low, indicating a resilient labour market.

Figure 1. US Nonfarm Payrolls. (Source: BLS, 2023.)

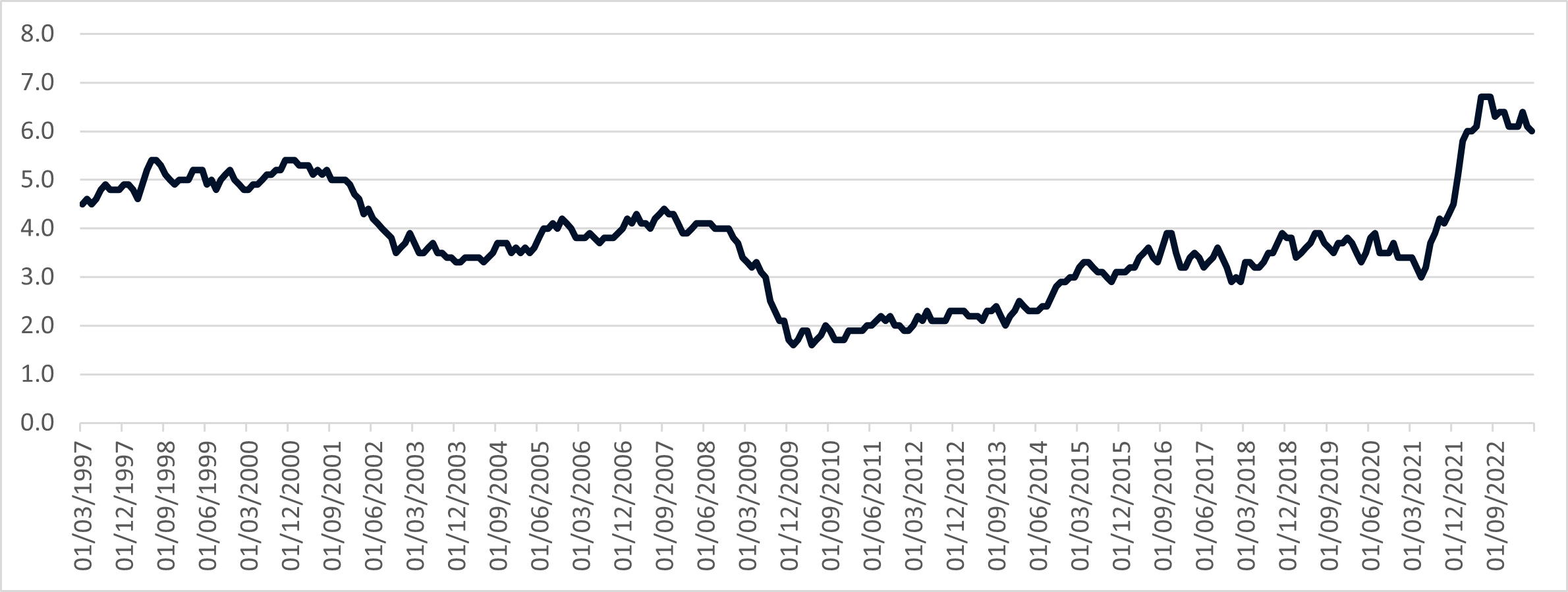

Wage growth is another factor closely monitored by the Federal Reserve. Currently, it stands at around 6% year-on-year. Higher wages translate to increased consumer spending, thereby driving inflation. Personal spending has also witnessed a notable increase, contributing to elevated inflation levels within the US.

Figure 2. US Wage Growth. (Source: Atlanta Fed, 2023.)

Core Inflation and Federal Reserve's Focus

Core inflation, which excludes volatile sectors like energy and food, remains above the Federal Reserve's target of 2%. This persistent elevation in core inflation prompts the Federal Reserve to adopt a more hawkish stance. With a strong labour market, their attention is primarily directed towards tackling inflationary pressures.

Federal Reserve Members' Outlook

Several Federal Reserve members expressed their views in May, providing insights into the future direction of monetary policy. Christopher Waller, a voting member of the Federal Reserve Committee, suggested further hikes in July. Federal Reserve members updated their June “dot plot” projections of monetary policy and revised their interest rate expectations upwards. The growing hawkish sentiment among Federal Reserve members indicates their commitment to addressing inflationary concerns among a backdrop of strong consumer spending.

Bond Yields, Equity Markets, and the Tech Revolution

The market response to the Federal Reserve's outlook can be observed in the movement of yields. As expectations of rate hikes increased, US bond yields, such as the US 2-year and 10-year, started moving up. This shift in yields reflects market participants' belief that the Federal Reserve will prioritise controlling inflation by raising interest rates amongst other things.

Interestingly, despite rising yields, the NASDAQ 100, a technology-focused growth index, continued to climb. This divergence from the conventional expectation, where rising discount rates lead to underperformance in growth stocks, can be attributed to the AI revolution. Companies like Microsoft, Apple, Amazon, Nvidia, Meta, and Alphabet, which contribute significantly to the NASDAQ 100, have been capitalising on the potential of artificial intelligence (AI) and witnessing substantial growth. This trend has attracted retail investors, driving their increased participation in US equities.

Figure 3. US 2-Year Treasury Bond Yield. (Source: MarketWatch, 2023.)

Figure 4. US 10-Year Treasury Bond Yield. (Source: MarketWatch, 2023.)

Narrow Market Breadth and Retail Investor Sentiment

The performance of the S&P 500, the US benchmark index, reveals a narrower breadth, with a few dominant companies outperforming the rest. This divergence from historical patterns indicates that the market is currently driven by a handful of large-cap stocks. Retail investors, driven by the fear of missing out, are keen to tap into the growth potential of these AI-focused companies, leading to increased investment in US equities.

Liquidity and the US Debt Ceiling Crisis

The recent uptick in liquidity in the market is another notable trend. Despite the US debt ceiling crisis, where the government faced borrowing limitations, liquidity has increased. This unexpected outcome can be attributed to the counterbalance between government spending and bond issuance. As the government continues to spend while facing borrowing constraints, liquidity injections such as the issuing of government bonds occur, impacting market dynamics.

Figure 5. Liquidity Driving Markets. (Source: StenoResearch, 2023.)

Looking Forward: 2024 Recession Risk

Leading Economic Indicators and Investment Patterns

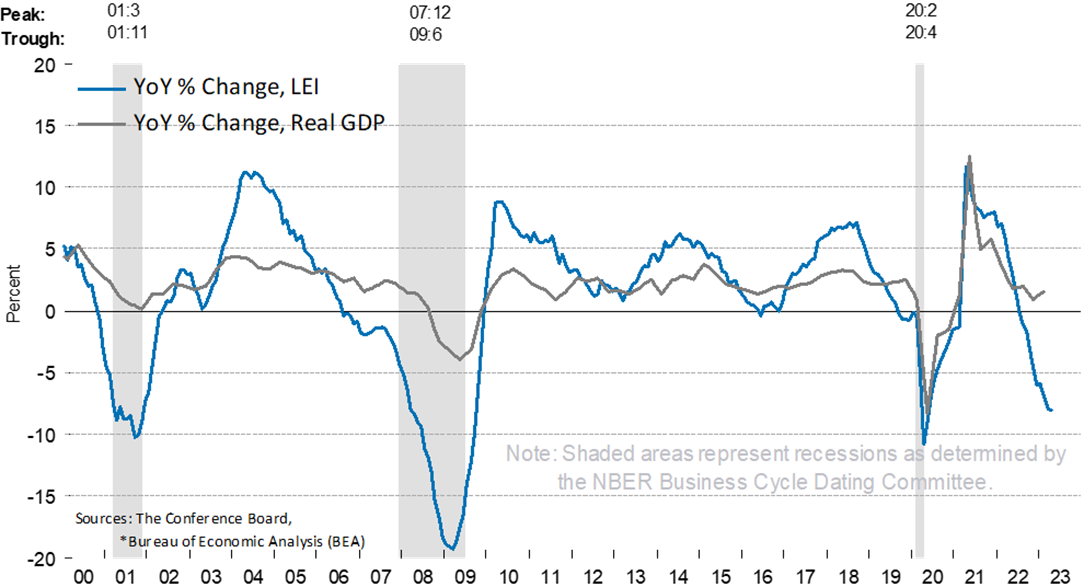

The Conference Board's Leading Economic Indicator, comprising various variables, serves as a reliable measure of economic growth and recessionary signals. The Conference Board is a global non profit think tank and business membership organisation that delivers trusted insight into what's ahead. Currently, the leading indicator exhibits a deep negative trend, indicating a possible recession in the near future.

Figure 6. Leading Economic Indicator. (Source: Conference Board, 2023.)

Examining specific segments of the economy, such as private residential fixed investment, reveals a significant relationship between investment in real estate and economic downturns. As interest rates rise, demand for mortgages and housing decreases, resulting in reduced investment in the construction sector. Given that residential real estate investment peaked about six months ago, it aligns with the 6 to 12 months timeline for a potential recession. Non-residential investment, which includes spending on factories and machinery, is also a critical indicator. The Goldman Sachs Capital Expenditure (CapEx) tracker suggests a potential decline in non-residential fixed investment, further emphasising the possibility of an economic slowdown.

Global Trade Labour Market Conditions

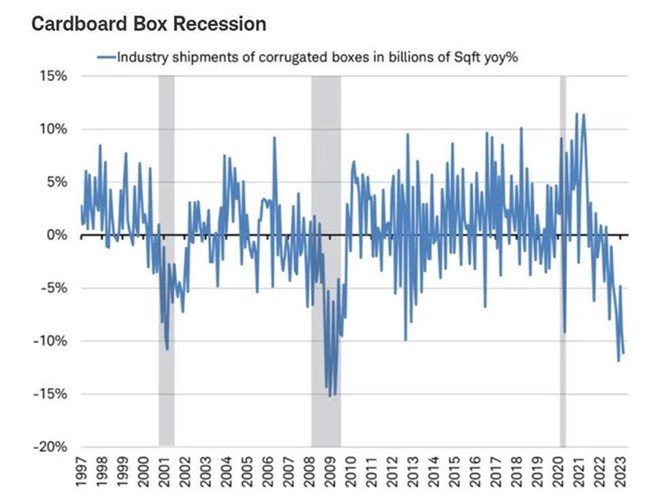

To gauge the demand for goods in the economy and the global market, alternative indicators such as cardboard box shipments and firm expenditures on freight provide valuable insights. Declines in these indicators during previous recessions demonstrate the interconnectedness between global trade and economic downturns. And this is what we are seeing at the moment - global goods trade is declining.

Figure 7. Cardboard Box Demand. (Source: DisruptorStocks, 2023.)

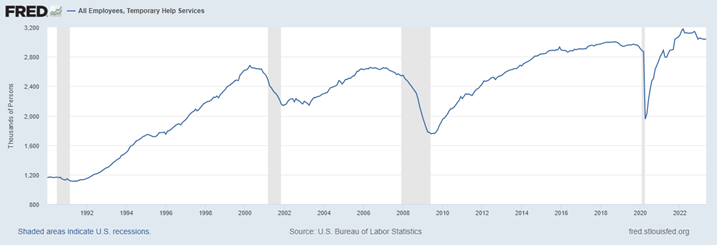

Labour Market Conditions

Analysing the labour market, employment in temporary help services is another effective leading indicator. Historically, peaks in temporary employment have preceded recessions, and negative year-over-year growth in this sector has consistently been followed by a recession. While the labour market remains robust, initial jobless claims have recently ticked up, signalling potential weakness in the future.

Figure 8. Employment of Temporary Help Services. (Source: Federal Reserve, 2023.)

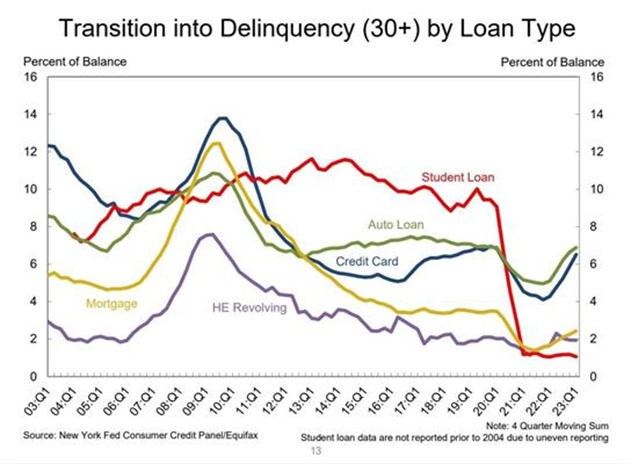

Consumer Strength and Financial Stress

Consumer spending, driven by excess savings accumulated during the pandemic, has been a significant factor supporting the economy. However, the estimated excess savings are gradually being depleted, indicating a potential decline in consumer spending within the next 6 to 12 months. Rising delinquencies on credit cards and auto loans - so late or non-payments - indicate rising financial stress, and restarting student loan payments could further strain consumer finances and lead to reduced spending in various sectors, negatively impacting economic growth.

Figure 9. Loan Delinquencies. (Source: NY Fed, Equifax, 2023.)

Summary

Despite the potential risks, several factors may help mitigate the impact of a recession. Household leverage (personal debt) is currently low, with debt service payments as a percentage of disposable income at multi-generational lows. This provides households with flexibility to borrow and spend, potentially bolstering economic activity. Additionally, business debt as a percentage of GDP, while reasonably high, is manageable, with a significant portion of debt not becoming due until later years and borrowings locked in at low rates.

Government spending remains substantial, which historically has injected demand into the economy. The government's current deficit of circa 5% of GDP suggests a level of support that can cushion the impact of an economic downturn. Moreover, the Federal Reserve's policy space, with room to lower interest rates if necessary, and the demonstrated ability of the Fed and Treasury Department to respond swiftly during the 2020 crisis provides additional reassurance.

In summary, there are some worrying indicators of recession. However, a combination of resilient consumers with low levels of personal debt and Governments willingness to step in when necessary might keep a full-blown recession at bay.

Note: This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Additionally, past performance is not a guide to future returns. Investment returns are not guaranteed, and you may get back less than you originally invested.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright