When everything seems too good to be true

This month’s update takes a look at the cautious optimism that is still evident in the investment markets, as a continued increase in vaccination rates indicate that the economic recovery that we are already seeing, should continue.

But with the ongoing threat of higher inflation, TPO’s Investment Committee reviews what has happened in the world markets and the role that fixed income investments play in balancing your investment portfolio.

In addition, what is happening to commodities such as gold, oil and copper. It would appear that we are entering a ‘commodity super cycle’. But what does this mean?

Market performance was mixed in May, with strong economic data being offset by ongoing fears of further rises to inflation and the possibility that a new COVID-19 variant will derail plans for the global economy to reopen.

We expect to see a pick-up in demand as economies begin to reopen. This may be complicated, however, by the continued disruptions in supply chains and the labour shortages that are beginning to emerge in certain industries.

This backdrop sets the stage for potentially higher inflation in the short term, putting Central Banks in the difficult position of withdrawing policy support too soon which would risk slowing the global recovery, or allowing labour shortages to feed through to higher wages, leading to potentially higher inflation and interest rates.

Investors lacking a clear outlook (if such a thing exists) have continued to invest in stocks and assets that are expected to outperform in an inflationary environment. As a result, the MSCI World Value index has outperformed the MSCI Growth index (3 % vs -0.1 %), European equities have continued to recover, returning 2.1% in May, and commodities have benefited from the pick-up in industrial demand.

Around the world

United States Markets

Compared to the same time last year, headline inflation increased from 2.6 % in March to 4.2 % in April. A rise in inflation was expected but the actual increase was above estimates. That said, the US Federal Reserve attributed the unexpected rise in inflation to temporary factors such as labour shortages which are not expected to persist.

The reopening of the US economy has also seen data about the recovery of the manufacturing and services sectors come in above estimates. Labour shortages in certain industries are being caused by attractive unemployment benefits, making it difficult to attract new workers into the labour force. Nonetheless, the unemployment rate fell to 5.8% in May as the US economy created 559,000 new jobs.

Corporate earnings in the first three months of the year showed a strong bounce back, with S&P 500 companies reporting earnings growth of 47% year on year (YoY), against 20% that had been expected.

Europe

The rate of vaccinations has picked up across Europe, with around 0.8% of the population per day in some of the major economies receiving a jab.

Progress with vaccinations and improving trends in coronavirus infection rates has allowed the EU to plan for a lifting of restrictions in July which is expected to fuel a growth in demand. This can be seen in the forward-looking data with the Purchasing Managers’ Index (PMI) rising to 56.9 (a 39-month high) and inflation rising to 2 % in May (from 1.6 % in April). A PMI of above 50 indicates that market conditions are improving. European equities have been supported on the back of this with the MSCI Europe ex-UK Index up 2.8% in May which makes it the best performing major equity index.

UK Markets

Domestic sectors performed well on the back of the reopening of the UK economy. Meanwhile large internationally diversified financial companies suffered following the strength in £ Sterling vs the US dollar.

The consumer confidence index has returned to pre-pandemic levels, and the service PMI has expanded at the fastest rate since 2013. Manufacturing PMI data for May was the highest in history, coming in at 66.1 compared to the expected value of 60.8.

The UK Consumer Prices Index (CPI) for April showed inflation of 1.5% compared to the same time last year, up from 0.7% in the previous month.

China

China's economic output, so the amount of goods and services produced, remains strong with both exports and imports exceeding pre-pandemic levels after increasing 30 % year on year in April. Since August, the services PMI has remained above 55, and the private Caixin manufacturing index has risen to 52.0, the highest level this year.

Industrial production and retail sales growth have benefited from the low 2020 data, but they continue to be strong. China relaxed its two-child policy on May 31st, allowing a third child, but economists believe this will have little impact on the country's ageing demographic problems.

Do we still need fixed income?

Fixed income broadly refers to those types of investment security that pay investors fixed interest or dividend payments until its maturity date. At maturity, investors are repaid the principal amount they had invested. Government and corporate bonds are the most common types of fixed-income products, which is why fixed income is often referred to by the broad-brush name of bond.

Since the Global Financial Crisis in 2007/08, bond market conditions have largely remained unchanged. Economic growth has slowed, inflation has remained low, and Central Banks have become a permanent fixture of the market because of massive stimulus measures.

This has led to a supportive environment for bond investors with major indices producing material returns (see Figure 1.)

| Index | 6 months (%) | 1 year (%) | 3 years (%) | 5 years (%) | 10 years (%) | Post GFC (%) |

|---|---|---|---|---|---|---|

| Bloomberg Barclays Global Treasury | -8.4 | -7.1 | 5.9 | 13.6 | 33.3 | 40.5 |

| Bloomberg Barclays Global Aggregate | -7.5 | -6.3 | 8.0 | 17.5 | 42.3 | 53.2 |

| Bloomberg Barclays Global High Yield | -2.8 | 1.7 | 13.7 | 40.4 | 108.4 | 254.8 |

Figure 1. Total return of major bond indices (3rd March 2009 – 7th June 2021) Source: FE Analytics

Given the decline in yields (as prices rise, yields fall) and the rise in inflation, we anticipate a more difficult environment for bonds in the future. However, we do not see persistently high inflation on the cards (at least in the US) as the five-year breakeven inflation rate remains higher than the 10-year rate, implying that inflation is higher in the short term but falls in the long term (see Figure 2.)

Figure 2. US five and ten year breakeven rates (source: FRED)

Sovereign Bonds

Longer-term government bond yields in the US, the UK, and Germany have all returned to pre-pandemic levels following the lows reached in 2020. In a historical context, however, yields remain low which calls into question the effectiveness of bond investing.

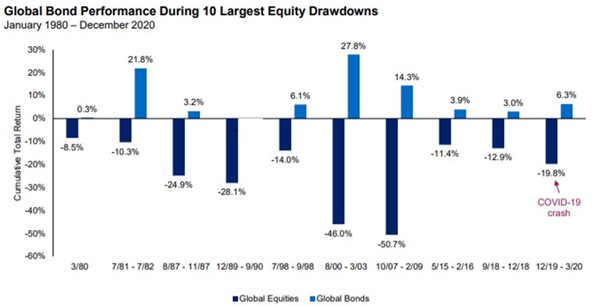

It is more useful to frame this argument in terms of portfolio construction rather than the absolute return a bond may provide in isolation. We have seen that in each of the ten largest equity downturns since 1980, global bonds outperform their global equity counterparts (see Figure 3.) - this means that bonds alongside risk(ier) assets can provide a degree of diversification.

Figure 3. Global bond performance during the 10 largest equity drawdowns (downturns) since 1980 (Source: AQR)

Are we in a commodity supercycle?

A commodity is a raw material or primary agricultural product that can be bought and sold, such as copper or coffee.

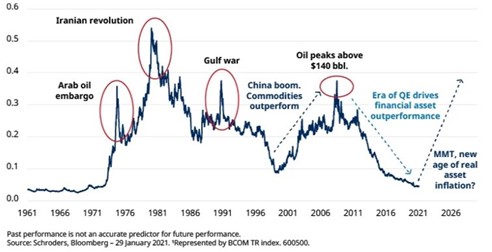

We can define a commodity supercycle as a decade long period in which commodities perform above their long-term average. We have seen four supercycles since the 19th century with the reindustrialisation of Europe and Japan in the late 1950’s and, more recently, the rapid industrialisation of China.

One of the arguments for a new supercycle is that commodities are trading at a low relative valuation compared to equities (see Figure 4.) Also, a weakening US dollar would be a tailwind for commodity prices because commodities are typically priced in dollars, requiring producers to raise prices to offset higher production costs in the local currency.

Figure 4. Relative performance of commodities vs S&P 500 (Source: Schroders)

The argument against the commodity supercycle is that we are emerging from a global pandemic, which has resulted in pent-up demand and supply chain disruption. This will naturally lead to an increase in prices, so distinguishing between price increases caused by cyclical factors and those caused by structural factors such as increased urbanisation in China and increased demand for electric vehicles will be a challenge.

Summary

The economy has most definitely seen some improvement recently, however we are conscious that things could change once more and we are susceptible to any event which disrupts the global economy reopening.

As such we continue to advocate for the use of a diversified portfolio that provides broad exposure to multiple types of asset, in order to manage the impact of anything that this uncertainly might bring.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright