First Republic – Another Banking Collapse. Should we be worried?

The recent collapse of First Republic, the second-largest bank failure in US history following the 2008 demise of Washington Mutual, has sent tremors through the financial sector. This article aims to delve into the causes and implications of the collapse, while providing a comparison to previous banking crises. Analysing the factors leading to First Republic's downfall will shed light on the challenges faced by the US banking sector and the subsequent ripple effects on the broader economy.

Comparing First Republic to past banking collapses

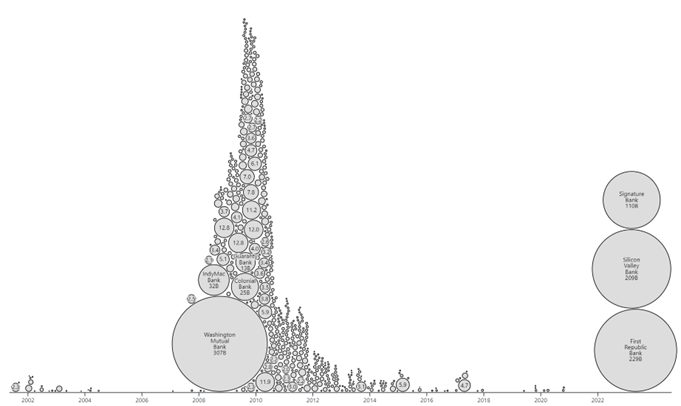

Figure 1. Bank Collapses. (Source: Observable, 2023.)

The magnitude of First Republic's collapse cannot be underestimated. Using a chart ranking US banking collapses by both date and size, it becomes apparent that the absolute impact of First Republic and its predecessor, Silicon Valley Bank (SVB), is significant. However, when considering the sheer number of collapsed banks, the recent events pale in comparison to the numerous failures experienced from the 1950s to the 1980s.

The role of SVB and uninsured deposits

The troubles for First Republic began with the collapse of SVB, which caused investors to panic and raised concerns about the stability of the US banking sector. One crucial aspect that exacerbated the situation was the fact that 67% of First Republic's deposits were uninsured. While the Federal Deposit Insurance Corporation (FDIC) provides coverage up to $250,000 per person, amounts exceeding this threshold are left unprotected. As SVB crumbled, investors withdrew their funds from perceived risky regional banks, seeking to diversify their uninsured deposits. This mass movement of capital triggered a degree of panic within the US banking system.

Asset liquidation attempts and the struggle of First Republic

Following a pattern similar to SVB, First Republic attempted to sell its assets to mitigate the crisis. However, the majority of the bank's net interest income and asset base consisted of government bonds, municipal securities, and real estate loans. The latter, being less liquid, presented challenges in meeting deposit requests, rendering the bank unable to fulfil its obligations.

The wider context

In this section, we will delve into the current state of the banking system and explore the conditions that have contributed to the challenges faced by financial institutions. By examining 2023 first quarter (Q1) earnings reports from major banks, analysing deposit and loan trends and evaluating the impact of unrealised losses on securities, we can gain insights into the overall health of the banking sector and identify areas of concern.

Q1 bank earnings and performance

When reviewing the Q1 earnings of prominent banks, it becomes evident that, on the whole, they have remained relatively healthy. JP Morgan emerges as a standout performer, experiencing substantial growth with a 50% increase in net income and a 25% rise in revenue compared to the previous year. With improved margins and positive performance across the board, most major banks have fared well in the first quarter.

Interest rates and income

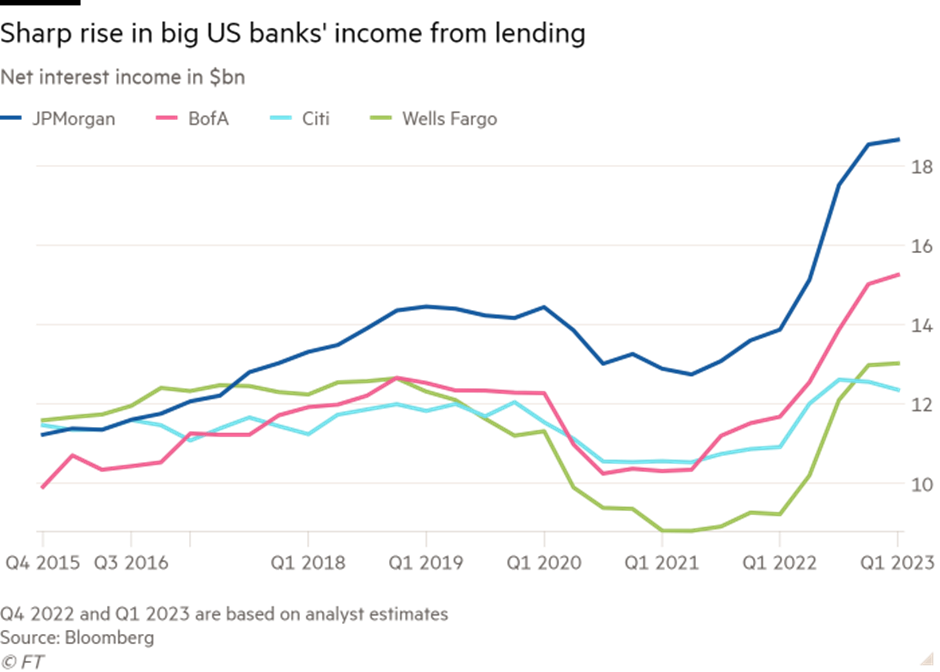

Figure 2. Bank Interest Income. (Source: FT, 2023.)

The increase in interest rates has played a significant role in boosting banks' profitability. As interest rates rise, banks charge higher rates on new loans, resulting in increased interest income as they can achieve greater margins on their loans. Notably, the fact that JP Morgan tends to offer shorter term loans has allowed them to take advantage of the higher interest rates more swiftly.

Deposit and loan trends

Figure 3. US Commercial Bank Deposits (top) and Loans (bottom). (Source: St Louis Fed, 2023.)

Traditionally, there is a positive correlation between deposits and loans, the more deposits there are, the more loans are extended. However, since mid-2022, deposit levels have been declining and in recent weeks the decline has accelerated. The decline can be attributed to flows into money market funds, rather than into deposits. Despite the decline in deposits, loans extended to the real economy have remained relatively strong, although there has been a slight slowdown. But this divergence raises concerns about the future impact on banks' liquidity and therefore ability to continue to lend.

Shifts in deposit distribution

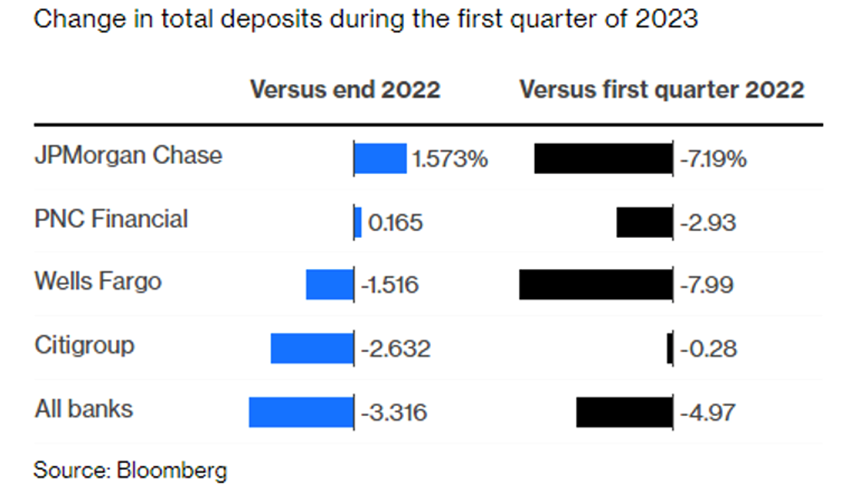

Figure 4. Q1 2023 Deposit Change by Bank. (Source: Bloomberg, 2023.)

Examining the changes in deposits among the 150 largest banks, it becomes evident that deposit flight has not affected all banks uniformly. JP Morgan, in particular, has benefited significantly from this shift. Deposits have moved away from weaker and smaller banks, flowing into larger and stronger institutions.

Why are depositors nervous? Unrealised losses on securities and capital adequacy ratios

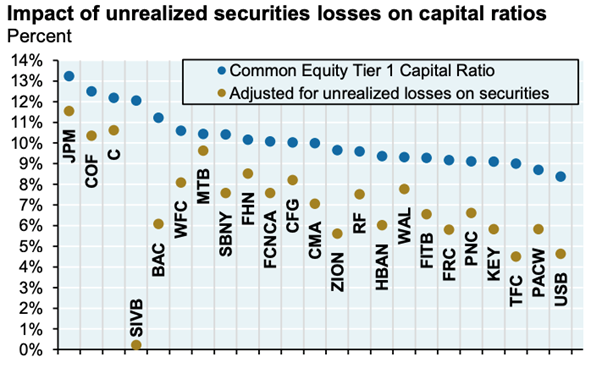

Figure 5. Impact of unrealised losses on securities holdings on banks capital adequacy ratios. (Source: SeekingAlpha, 2023.)

Unrealised losses on their investment securities have impacted banks' capital adequacy ratios – so its ability to meet its obligations - to varying degrees. While smaller banks have experienced more significant impacts, larger, institutionally important banks have weathered the storm relatively well. The fact that larger banks have maintained safer leverage ratios provides some reassurance regarding their stability compared to smaller banks.

Why are depositors nervous? Challenges in commercial real estate

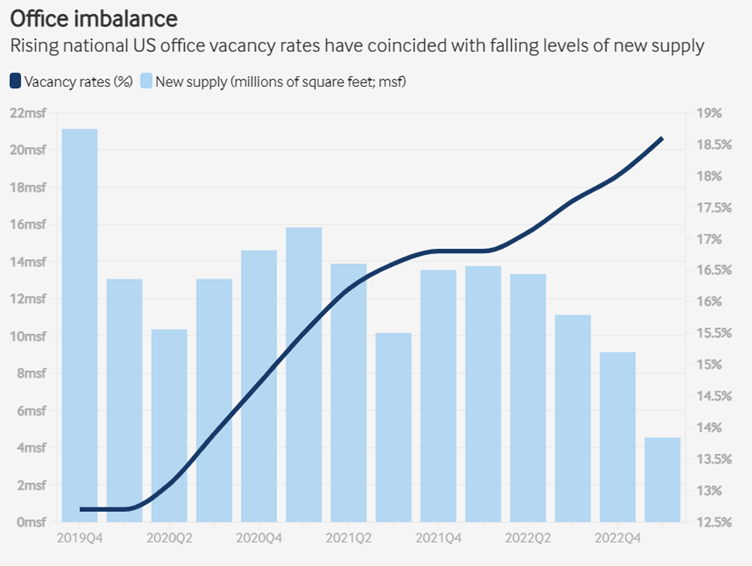

Figure 6. Rise in US office vacancy. (Source: FDI Intelligence, 2023.)

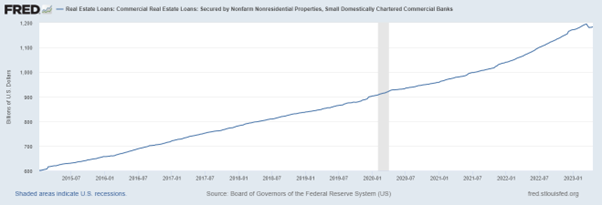

Figure 7. Rise in small US Bank lending to commercial real estate. (Source: St Louis Fed, 2023.)

Commercial real estate, particularly office spaces, has become an area of concern for banks. With the rise in remote work and increased office vacancies, tenants are struggling to make payments, impacting the loans tied to these properties. Small banks have a higher exposure to commercial real estate loans and this exposure has contributed to depositors' nervousness and their concerns about the value of their deposits.

Why are depositors nervous? Funding mix and profitability

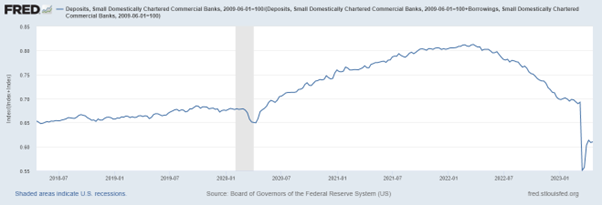

Figure 8. Proportion of US Small Bank funding themselves through deposits. (Source: St Louis Fed, 2023.)

The funding mix of banks has shifted, particularly for smaller banks, with a notable move away from being able to raise money by attracting deposits and therefore toward borrowing from capital markets, as this is increasingly their only option. While deposits are generally considered safer and more stable, capital market borrowing carries higher risks and interest costs. Banks face increased scrutiny from capital market investors, who can swiftly withdraw funding. This shift in funding mix poses challenges to profitability for banks due to higher funding costs in capital markets.

Conclusion

The health of the banking system is multifaceted and impacted by various factors. While major banks have displayed overall stability and positive performance, concerns regarding deposit flight, commercial real estate, and funding mix pose challenges for smaller banks. The continued relative strength of larger banks, such as J P Morgan, will be an important factor in preventing a crisis amongst smaller regional US banks becoming a more significant broader, economic crisis.

Note: This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Additionally, past performance is not a guide to future returns. Investment returns are not guaranteed, and you may get back less than you originally invested.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright