How long will interest rates hold?

This month’s update continues with the theme of optimism, with increased economic activity, further progress on the vaccine rollout and recent company earnings figures that are well ahead of estimates.

But with threats of virus variants and an expected rise in inflation around the corner, do we still need to be cautious on the outlook?

The belief that the greatest risk to the Markets is what policy decisions the Central banks will make. They have stated in no uncertain terms that they will wait for higher inflation to be proven to be here to stay, as opposed to any temporary increases that might occur, before making any decisions on interest rates.

The difficulty will be to distinguish between inflation caused by a breakdown in the manufacture and delivery of goods caused by world events, and inflation caused by increased demand as we all start spending our hoarded cash. The former is detrimental to a country's economic growth, but it is also more likely to be temporary, while excess demand (the idea that too much money is chasing too few goods) is likely to be longer lasting and coincides with lower unemployment and a country's growth rate rising above its long-term trend.

United States Markets

25% of the US population has been vaccinated in the last two months, bringing the total number of Americans who have received at least one COVID-19 vaccination to approximately 46%.

To put this in context, only 26% and 32% of the population in France and Germany have received one vaccine, respectively. This divergence in vaccination progress has resulted in a positive outcome, with the S&P 500 returning 11.8% year to date and US GDP growth estimates revised to 8.6% annualised in Q2 (Quarter 2). GDP – or Gross Domestic Product - is a measure of the size and health of a country’s economy. When GDP goes up, the economy is growing.

Company earnings have exceeded expectations, with previously underperforming economic sectors beginning to outperform.

So far in the first quarter of earnings season, 86% of companies have reported earnings above estimates, which is higher than the five-year average of 74%. It's not just the frequency of companies reporting higher-than-average earnings; it's also the magnitude, with average earnings expectation beaten by 22.1% compared to a five-year average of 6.9%.

With these stellar increases in earnings, investors are wondering if inflation will rise. The Federal Reserve predicts that any increase in inflation will be temporary and that meeting their average 2% target will remain difficult; however, the Market appears to believe otherwise, as breakeven rates (the difference between the yield on nominal Bonds and yields on inflation-linked Bonds of the same term) have risen, with the 5-year rate now at 2.68% (the rate was 1.98% at the start of the year).

But, if inflation rises, we can expect more volatility in Bond Markets as the prospect of an interest rate hike rises, which, all else being equal, lowers the price of a Bond. However, in a world of low returns, any increase in yields would make Bonds more appealing to investors, so rather than an outright increase in yields, you may see a ‘staircasing effect’ as investors take advantage of any price drops.

UK Markets

The vaccination rollout in the UK continues, with over 35 million adults or more that 53% having received at least one vaccination. There is also a decrease in vaccine aversion, with YouGov reporting that only 11% of respondents are hesitant about getting a vaccine, compared to 39% in November.

According to the most recent GDP figures, the UK economy decreased by 1.5% in Q1 because of renewed lockdown restrictions; however, this is significantly lower than the 19.5% contraction seen during the first lockdown.

Andrew Bailey, Governor of the Bank of England, said that while inflation is likely to be "a little bumpy," there is no expectation of a sustained increase in inflation. Inflation is expected to rise above 2% in the short term as energy prices, among other items, begin to rise from last year's lows and as lockdown restrictions are lifted - but will fall to around 2% in the medium term.

Europe

Europe's vaccination rollout has continued to struggle, with the Continent vaccinating just under 25% of its population – but there is a wide disparity between Countries, with Belgium vaccinating 31% of its population while Croatia has vaccinated just 22%.

The Eurozone economy decreased by 0.6% in Q1, according to GDP data, but forecasts are becoming more optimistic, with the manufacturing PMI (Purchasing Managers Index) survey continuing to rise and reaching a new high of 63.4. If this figure is above 50 it means that the sector is growing, so this is positive news.

Inflation in the Eurozone rose to 1.6% in April (from 1.3% in March) as the European Central Bank increased the pace of its asset purchases in response to the pandemic, while the intermittent reopening of the economy has acted as a tailwind to inflation.

Germany's constitutional court dismissed an appeal against the formal consent of the EU’s €800bn pandemic recovery fund, which is set to be distributed from July, assuming there are no further complications. This stimulus is expected to add 3.5% to the Eurozone's GDP and help the Bloc return to pre-pandemic growth levels.

Japan

Japan has lagged behind its developed Market peers in Equity Markets, with the TOPIX up 6.2% year to date, as the country deals with the fallout from the pandemic, which has compounded the country's pre-pandemic anaemic growth and productivity.

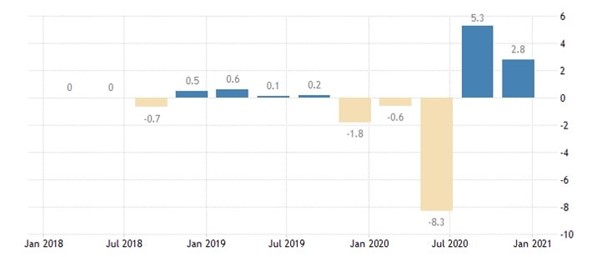

Following three periods of negative GDP growth in 2020, the country had shown signs of recovery, with consecutive positive GDP readings of 5.3% in in the last three months of 2020 and 2.8% in the first three months of this year (see Figure 1.). This was due in part to new Prime Minister Yoshihide Suga's increased economic measures to help stimulate the economy, but also to the recovery in China and South Korea, which helped boost the country's export Market.

Figure 1. Japan's GDP Growth Rate (Source: Trading Economics)

As the world reopens, we can expect this to be a tailwind for Japan, the world's fourth largest export Market, but it will not solve the country's chronically low inflation problem. There have been pockets of inflation because of supply chain constraints and the weakening of the Yen, which, while boosting exports, has weighed on domestic spending with companies passing on higher prices to consumers; however, these are expected to be temporary.

The Bank of Japan announced last month that they are unlikely to meet their inflation target of 2% through 2023, and that interest rates will remain unchanged at -0.10%.

China

China has taken steps to reduce leverage within the economy, which will reduce GDP growth to around 6% from the consensus estimate of 8.4% and reduce the country's shortfall in Government spending compared to its income, from 3.6 to 3.2%.

Importantly, the National People's Congress is confident that a 6% growth rate can be achieved without additional economic stimulus, putting the country in an enviable position when compared to its peers who are still engaging in massive monetary and fiscal spending.

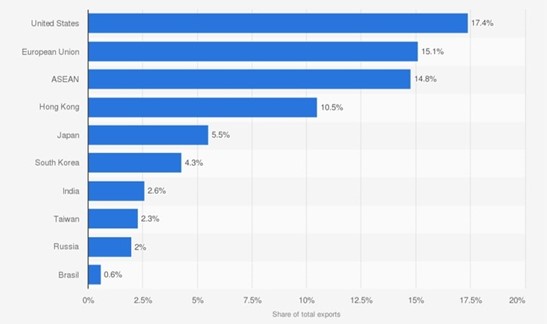

This will, however, be a balancing act, and there is a risk that too much liquidity will be removed from the economy too soon. This could be worsened by any peripheral risks we see in the Chinese economy, such as the US' decision to strengthen its critical supply chain. Any tighter import controls imposed by the US would harm Chinese exports, given that the US accounted for roughly 17% of all Chinese exports in 2020 (see Figure 2.).

Figure 2. Distribution of Chinese Exports in 2020 (Source: Statista)

Summary

It has been a great start to the year for Equity Markets driven by several tailwinds. For Bonds, the performance has been much more normal for the early stages of a cyclical recovery.

That said, this not a normal recovery and the threat of new variants of COVID could dent demand as international travel returns. It remains to be seen whether Equity Markets can maintain the current rate of increase but to do so, company earnings growth must push ahead of expectations. We are cautious on such an expectation.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright