Spring out of lockdown

The US earnings season has begun in earnest, which is when a large number of publicly traded companies release their quarterly earnings reports. The results of this will give us a good indication about whether the optimism that we are seeing in the markets is justified. We’re looking for a sustained period of recovery from companies in the world’s largest economy, otherwise performance could be derailed, which is why this is important.

Throughout the first three months of the year the recovery theme dominated investor sentiment, as markets looked forward to a bounce in activity fuelled by Government use of monetary and fiscal policy to stimulate the economy, economies are now opening up following lockdown, and underpinned by progress in the vaccination programme.

The performance of markets clearly reflect this theme with most equity markets making a strong start to the year led by smaller companies which would be key beneficiaries of any upswing.

US Markets

President Biden achieved his first legislative victory with the approval of a $1.9tn pandemic relief package. The policy has been well received, not least as it saw individuals receive $1,400 dollar cheques as well as an extension to the federal emergency unemployment benefits.

A further $3tn stimulus package has also been proposed, which would look to target the USA’s ageing population. This is expected to be challenged by some members of the Democratic party due to concerns about some aspects of the plan.

Unemployment fell to 6% in March as non-farm payroll data showed that 916,000 jobs were added in March (the highest recorded since August) and above the consensus estimate of 650,000. This is driven in the main by the US’s progress on vaccinations, which has reduced some of the restrictions on the jobs market and has raised the prospects that lockdown will be lifted.

The Federal Reserve has indicated that inflation will increase, but not to levels of concern and that they believe interest rates will remain low.

UK Markets

The UK has welcomed the opening of non-essential shops, gyms and pubs, as it eases out of the third lockdown. The next significant stage will be , allowing international travel once again and being able to hug some of our friends and family.

This success of the UK’s vaccination rollout has seen the International Monetary Fund (IMF) upgrade the UK’s growth forecasts to 5.3% in 2021 and 5.1% next year, which, if achieved, would make the UK the fastest growing advanced economy in 2022.

UK construction activity grew at its fastest pace since 2014 with the construction Purchasing Managers’ Index (PMI) rising to 61.7 from 53.4 in February – any value above 50 means that the sector is growing, so this is positive news. Importantly whilst residential builds continue to be supported by the stamp duty holiday, we also saw a number of commercial projects restarting.

The Initial Public Offering (IPO) of Deliveroo ended in spectacular fashion, becoming one of the worst IPO’s in London’s history, with the stock closing down 26% on its opening day. The combination of ongoing legal problems regarding the classification of the company’s workforce and that back in 2019 the valuation of the company was just £2.9bn vs the £7.9bn original IPO valuation, left investors unimpressed and shows that there is such a thing as a “too expensive” stock.

Europe

The EU recovery fund continues to be dogged by political infighting - all member states must pass similar legislation to allow the European Commission to establish the fund, but there is some confusion, with member states concerned around where the money will be going, how will it be repaid, and the precedent it will set moving forward.

This delay in stimulus and in vaccination rollouts throughout the EU, compared to the US for example, has seen European growth forecasts fall from 4.3% to 4.1% this year.

Eurozone inflation increased to 1.3% in March from the previous month’s reading of 0.9% - this remains below the ECB’s target of 2% but was the largest increase since the pandemic began last March. Whilst as a whole there has been an increase in inflation, there are several member states (most notably Greece) who remain in negative territory, which highlights that the pandemic’s impact is not a one size fits all.

There is now further clarity on Europe’s Green Deal with Frans Timmermans (executive Vice President of the European Commissions) stating in unequivocal terms that “fossil fuels have no viable future”. This was notable because, for one, it was at Eurogas’s annual meeting (an association which covers the wholesale and retail European gas sector) and there was some ambiguity as to how fossil fuels (in particular fossil gas) would be used as an intermediary while Europe moved to net zero emissions by 2050.

China

The IMF increased China's GDP growth forecast to 8.4% this year as the country begins to pick up momentum again.

As with the UK this is an illustration of the country's success on vaccination rollouts, as they have set the ambitious target of vaccinating 40% of their population by the end of June. This is already having an impact as cross border travel has been lifted and during the recent Qingming festival, domestic tourism was reported to be close to pre-pandemic levels.

The State Administration for Market Regulation fined Alibaba $2.8bn dollars after it was found to be breaching monopoly laws. The fine was equivalent to 4% of Alibaba’s sales in 2019 so not hugely material but it is powerfully symbolic as one of the countries key aims was to reduce the control that large technology companies have on the sector and on the wider society.

Earnings season

US earnings season is upon us and the expectation is that the earnings growth rate for the S&P 500 will be 24.5% which, if achieved, would be the highest rate since the third quarter of 2018, which was 26.1%.

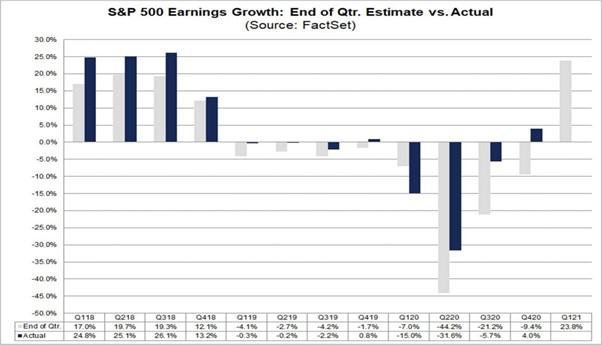

We must also consider that since 2018 there has only been one incidence where the expected earnings growth rate was above the actual earnings growth rate (see Figure 1.). This means there is a strong likelihood growth could be greater than 24.5% and if we assume that the upward revision will be in line with the last five years of earnings improvement, then we could see a figure as high as 28%.

Figure 1. Earning growth rate estimate vs actual figures (2018-2021) (Source: FactSet)

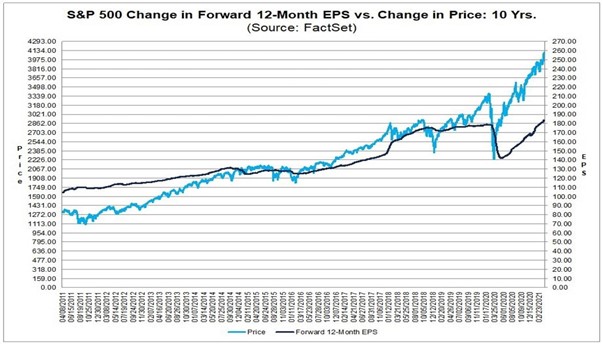

This is important when you consider how expensive the S&P 500 is on a price-earnings (PE) basis. The forward PE ratio (which looks to compare the price of a stock with its next twelve months of earnings) is higher than its five and ten year average, so investors are paying more on a relative basis (see Figure 2.).

Figure 2. Price and Forward EPS of the S&P 500 (2011-2021) (Source: FactSet)

To reduce this, we need to see both the figures from the first three months of the year to come in as expected (if not higher) and arguably more importantly that there is strong forward guidance that earnings will pick up throughout 2021. This leaves the market in a susceptible position as any negative surprise could derail the performance we’ve seen in the S&P 500 – which has been just over 10% so far this year.

Summary

Cautious optimism combined with volatility is likely to be the near future for markets, and as always we will be monitoring conditions in these markets, interpreting new information and establishing what it means for your portfolios. It is our job to ensure plenty of diversification and ensure we keep the risk of your investments to an appropriate level, in order to iron out this volatility.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright