The question is when rather than if

This month we explore how investors might be rewarded for holding a diversified portfolio and whilst one cannot time the markets the outlook for asset prices remains positive this year.

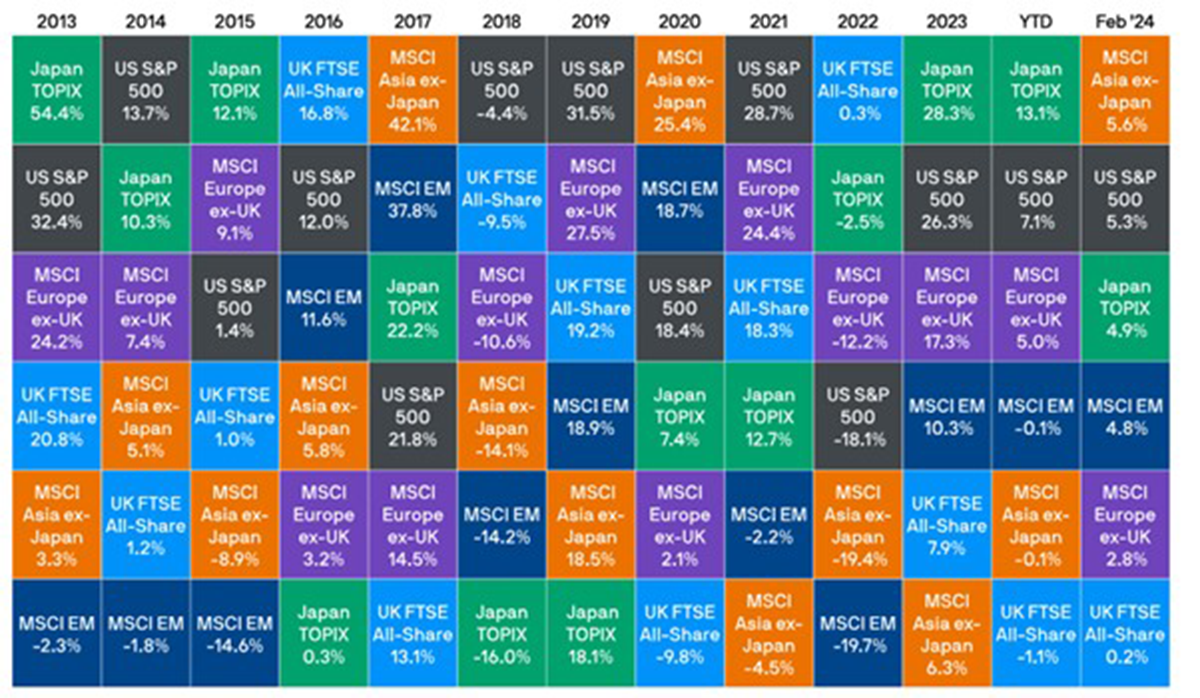

Global Equity Performance

Last month was another strong month for equity markets with the S&P 500 reaching a record high as earnings for the “Magnificent 7” did not disappoint investors, a (long awaited) rebound in Chinese equities supported broader Asia, the Nikkei index in Japan reached a high not seen since December 1989 and European equities whilst underperforming relative to their US equity peers produced positive returns in the month (see Figure 1.).

Figure 1. World Equity returns, Source: JP Morgan, 29th February 2024

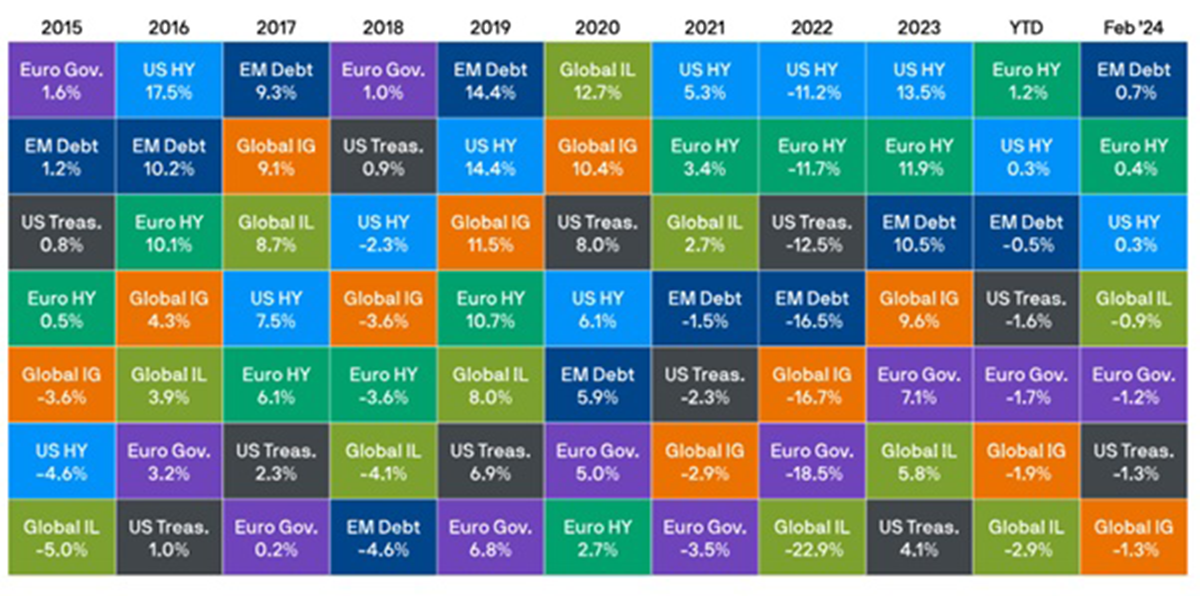

In fixed income we saw positive returns from high yield (a form of riskier corporate debt and less sensitive to interest rate expectations given its low duration) which is no surprise considering the positive return in risk markets such as equities. US and European Government bonds were down in the month as stronger inflation data saw investors push back their expectations of a cut in interest rates, meanwhile continued strength in UK wage data saw the price of Gilts fall as investors also revised their expectations of when the Bank of England will cut interest rates (see Figure 2.).

Figure 2. World Fixed Income returns, Source: JP Morgan, 29th February 2024

Diversification importance

Some of you reading this will have already noted that with equities going up in price and bonds falling in price, it means that the two asset classes exhibited negative correlation and offered investors the opportunity of diversification. That word (diversification) which has eluded investors in recent years as equities and bonds moved in tandem, going up together (most recently in October of last year) and falling together with the most notable example being in January 2022 when Central Banks reopened the quantitative tightening policy playbook and began to hike interest rates from historic lows.

As we move through this year the feature of ‘diversification’ and the idea that having exposure to multiple asset classes and regions is an optimal approach to one’s investment journey is something I expect to continue and will look to substantiate in this update. I’m cognisant though and to plagiarise the widely used quote that “history does not repeat but it rhymes”, it’s not as simple as to suggest simply repeating what was successful last time.

Interest rate expectations

Interest rates are expected to be cut this year as inflation data in the developed world has fallen materially from the highs of 2022. UK inflation in October 2022 was 11.1% and recently came in 4% year on year (which was even below analyst forecasts) and whilst the US - which has been the poster child for the soft-landing narrative - saw its most recent inflation print increase, this was to 3.2% which is a long way from the 9.1% inflation rate that was recorded in June 2022.

This sets the stage for a cut in interest rates which the market is anticipating will occur in Q2 of this year and with it the potential for bonds to reassume their rightful place as a diversifier in portfolios along with offering investors a positive return.

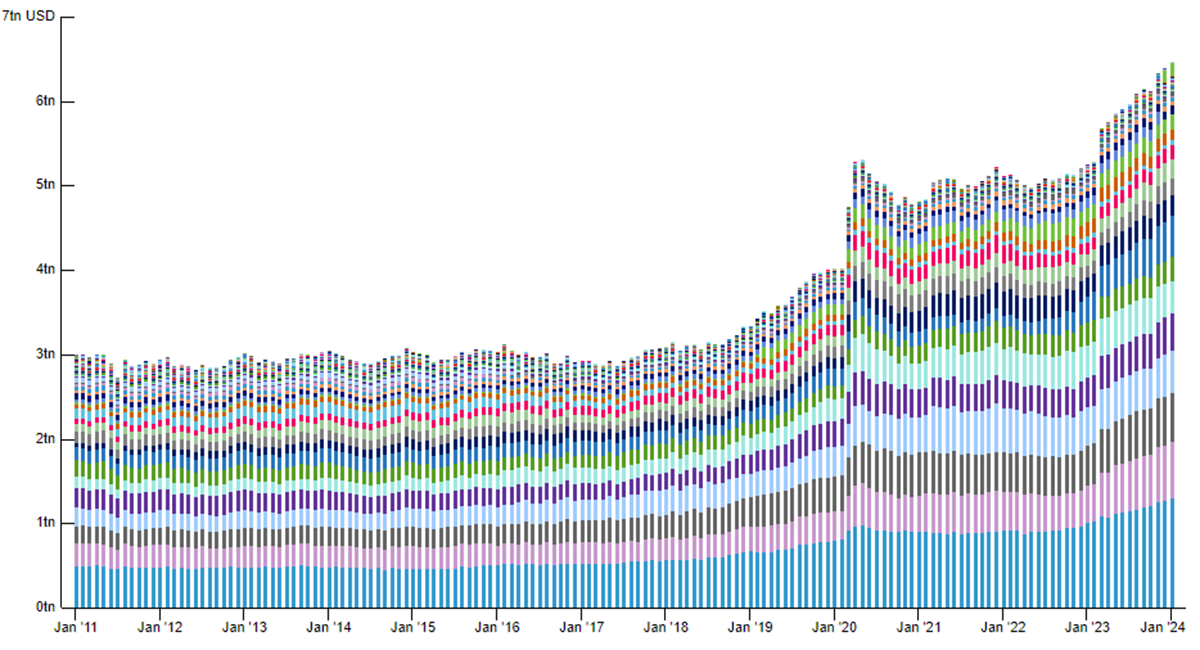

A fall in interest rates will also have implications for other asset classes. Money market funds which have attracted significant flows in recent times and have seen the Assets Under Management (AUM) in US money market funds reach c. $6.5tn (see figure 3.) will see their relative return fall as the interest on the funds is directly linked to the interest rate set by Central Banks.

Figure 3. Total assets in US Money Market funds, Source: OFR Analysis, 31st January 2024

The question then posed is will the prospect of reinvestment risk (reinvesting one’s income at a lower rate than previously invested) see increased inflows in equity markets as investors look to achieve a higher return.

Research by Schroders showed that since 1928 there have been 22 interest rate cutting cycles in the US and that on average, equities have outperformed cash by 9% in the 12 months after the first cut in interest rates. Bonds have also typically outperformed cash with an average outperformance of 3%.

Regional opportunities

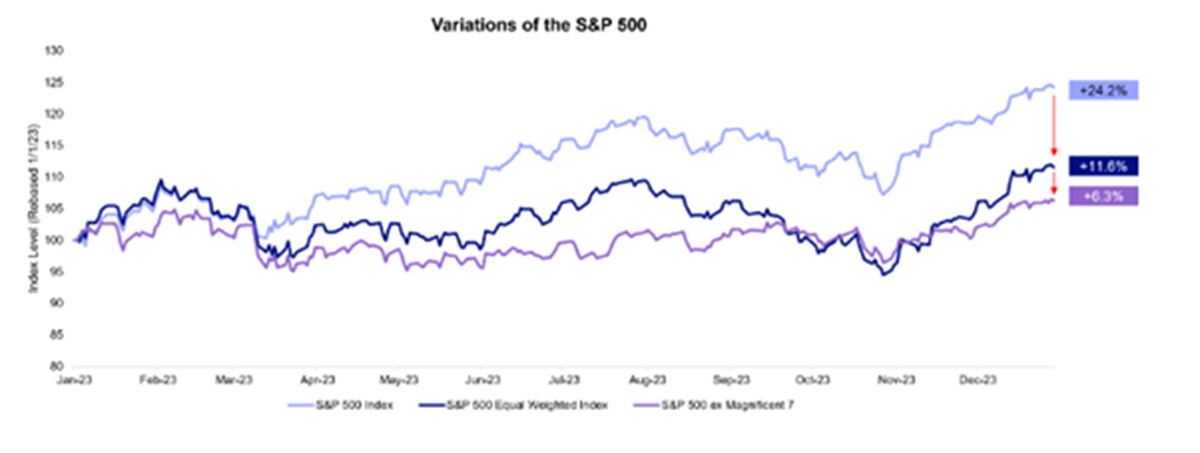

Referring to my earlier point about not repeating exactly what worked previously. Much has been made about the recent performance of the ‘Magnificent 7’ (see figure 4.) and the rich valuation of US equities compared to the broader US equity market. Whilst there are reasons to support the continued outperformance of these companies (high free cash flows, low levels of debt and durable business models) this is not the same as saying that all the other 493 listed companies in the S&P 500 or more broadly non-US equites will underperform.

Figure 4. Performance of the ‘Magnificent 7’, S&P 500 index, S&P 500 equally weighted index last year, Source: OFR Analysis, 31st January 2024

US exceptionalism – the idea that the US economy has better relative growth, more dynamic financial markets and a strong currency – has long been touted as a reason for the continued outperformance of the US equity market and whilst this is certainly one reason, there are a number of reasons to think we may see this exceptionalism wane at least in the short term.

This is in part due to the fact that the market is pricing in a soft landing in the US and that the Federal Reserve has been able to implement the ‘perfect policy’ (I remain sceptical) but also that investors remain pessimistic on the outlook for other regions.

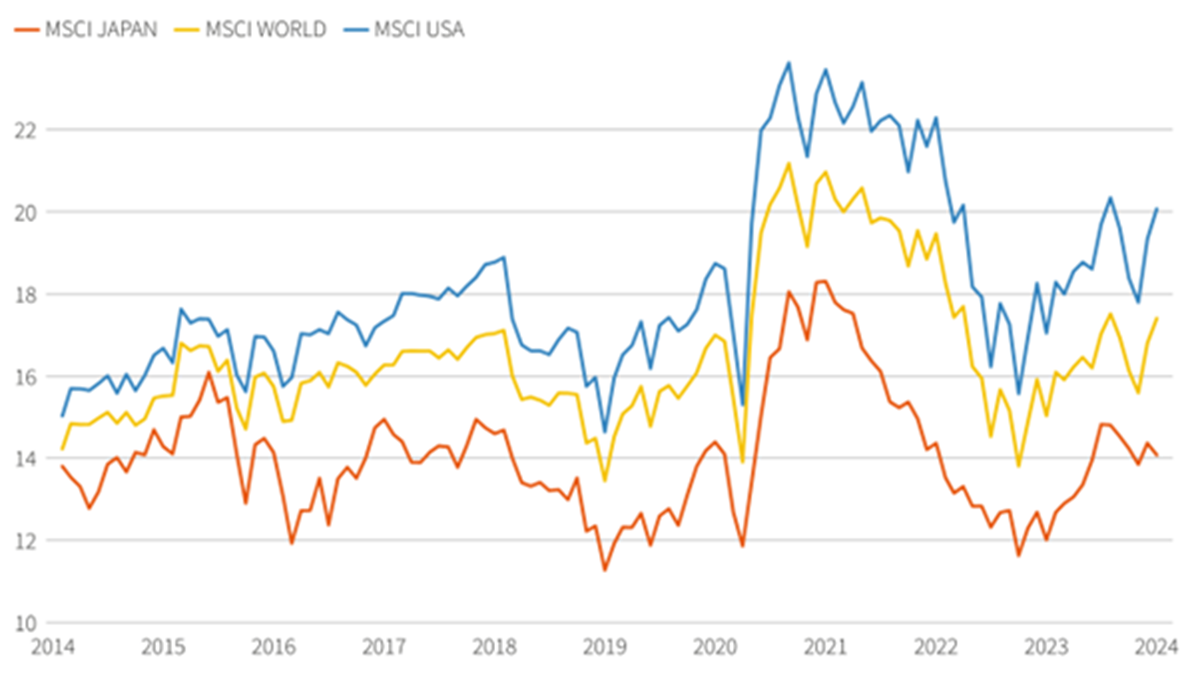

Leading economic indicators in Europe are beginning to trend up, global factory activity is increasing, and investors are beginning to reassess their view on equities outside of the US specifically given the divergence of European equities compared to US equities. Another potential opportunity lies in Japan where corporate governance reforms and interventions from the regulator will likely see continued support for Japanese equity markets and there looks to be continued price upside considering that the market trades on a cheaper valuation to its global peers (see Figure 5.).

Figure 5. Forward Earnings of equity markets, Source: LSEG & Reuters, 23rd February 2024

Conclusion

Putting all of this together suggests that investors will be rewarded for holding a diversified portfolio and whilst one cannot time the markets the outlook for asset prices remains positive this year.

Investment Champion uses the expertise of the Investment Team at The Private Office to create simple to understand investment portfolios that offer an alternative and cost-effective way to make your money grow. The Investment Champion portfolios provide diversified investment exposure across a range of geographies and asset classes in order to produce attractive risk-adjusted returns for investors. These portfolios use passive funds which track the performance of a benchmark and are not actively managed by a fund manager. They therefore offer a cost-effective solution to building a portfolio.

Investment Champion uses the expertise of the Investment Team at The Private Office to create simple to understand investment portfolios that offer an alternative and cost-effective way to make your money grow. The Investment Champion portfolios provide diversified investment exposure across a range of geographies and asset classes in order to produce attractive risk-adjusted returns for investors. These portfolios use passive funds which track the performance of a benchmark and are not actively managed by a fund manager. They therefore offer a cost-effective solution to building a portfolio.

This market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions.

Past performance is not a guide to future returns. Investment returns are not guaranteed, and you may get back less than you originally invested.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright