Silicon Valley Bank - Systemically Very Bad?

Some significant news that occurred in the last couple of weeks was the collapse of the US’s 16th largest bank, Silicon Valley Bank (SVB). Whilst this won’t have affected any retail savings customers in the UK, it has had an impact on investment markets and has raised concerns about whether there could be another banking crisis on the horizon. As a result, we feel it is important to focus on what happened in this month’s Investment Market Update.

Markets have been in shock after Silicon Valley Bank (SVB) failed and was taken over by regulators recently. In summary, the failure was caused by poor risk management and lack of diversification in funding sources, leading to vulnerability and then to a bank run. However, regulators declared SVB systemically important and therefore guaranteed all deposits, creating a new lending facility to prevent future bank runs. The market reaction to this failure has, understandably, been negative, with bank stocks and broader equity markets falling, and with Swiss banking giant, Credit Suisse, being particularly impacted by the news. However, the situation is still unfolding, meaning the market impact may change over time.

What happened to the Silicon Valley Bank?

To understand what happened to the bank it is useful to know the basics of a bank balance sheet.

| Assets | Liabilities |

|---|---|

| Long-term Securities (US Govt. Treasury Bonds) | Deposits |

| Long-term Loans to businesses | Short-term borrowing |

Banks make money by owning investment assets and funding them with the money they get from depositors, along with short-term borrowings. Deposits are essentially loans from the depositors to the bank, but depositors can demand their money back at any time. If a bank gets more deposits than it can lend out, it puts the extra money into what are considered ‘safe’ investments like government bonds. There is also a regulatory minimum holding of safe assets.

The bank holds government bonds in two different groups. One group is called "Available for Sale" (AFS), and the other is called "Hold to Maturity" (HTM). The AFS bonds can be protected against changes in interest rates, while the HTM bonds cannot. When the bank records the value of its bonds on its balance sheet, it can either use the market price of the bond (AFS) or assume it will be held until it matures and price it based on the interest received by the bank (HTM).

When the bank invests in the AFS bucket and the market value of these bonds goes up or down, the gains or losses are recorded. However, these gains or losses do not directly impact the bank's profit or loss statement. Instead, they are recorded in a separate account, called the Other Comprehensive Income (OCI) account, which is a part of the bank's equity. These losses/gains impact the capital buffers used to insulate against loan losses but do not impact the bank's profit or loss statement.

On the other hand, securities held in the HTM bucket are not marked to market, which means that the changes in the market value of the securities do not impact the profit or loss nor the capital buffers of the bank. This is because the HTM securities are purchased with the intention of being held until maturity, and any change in their market value is not relevant unless the bank intends to sell them before they mature.

Liabilities

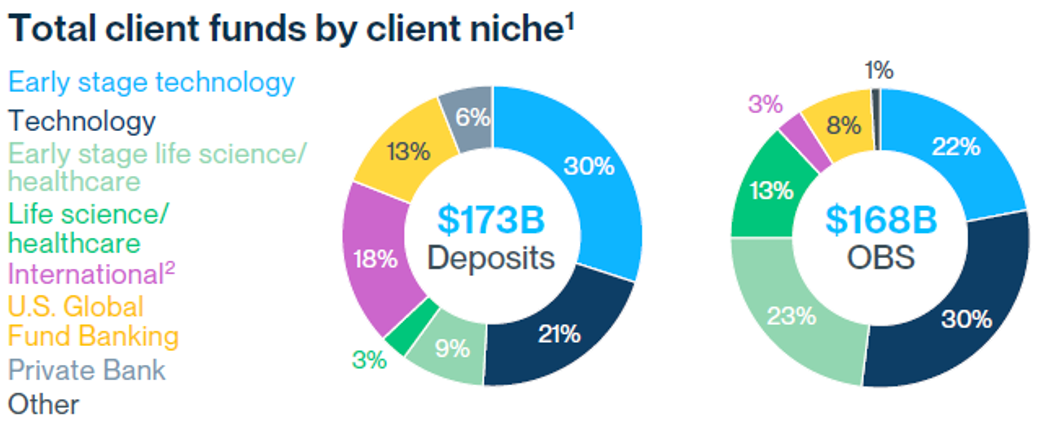

Figure 1. SVB Client Funds Breakdown. (Source: SVB Annual Report, 2022)

Now, let's look at SVB. As the main banker for technology venture capital (VC), SVB has a lot of money from a small group of depositors – effectively tech start-up companies. Typically, banks serve many different types of customers, so if one group withdraws money, it doesn't affect the bank too significantly.

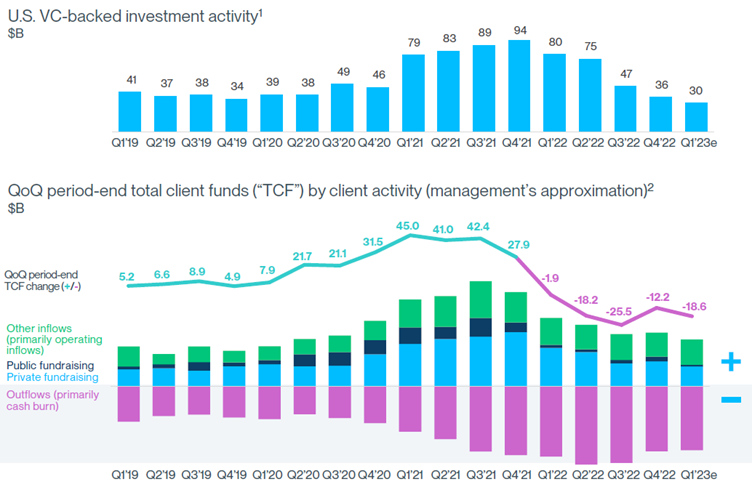

Figure 2. SVB Client Funds Inflows/Outflows vs VC Activity. (Source: SVB Annual Report, 2022)

The graph above shows how this deposit base profile impacted outflows. Because many of these VC backed firms were not yet profitable, they relied on fundraising inflows to balance the cash reserves that were being used – this is known as cash burn. As interest rates rose VC fundraising slowed and failed to balance the cash burn outflows.

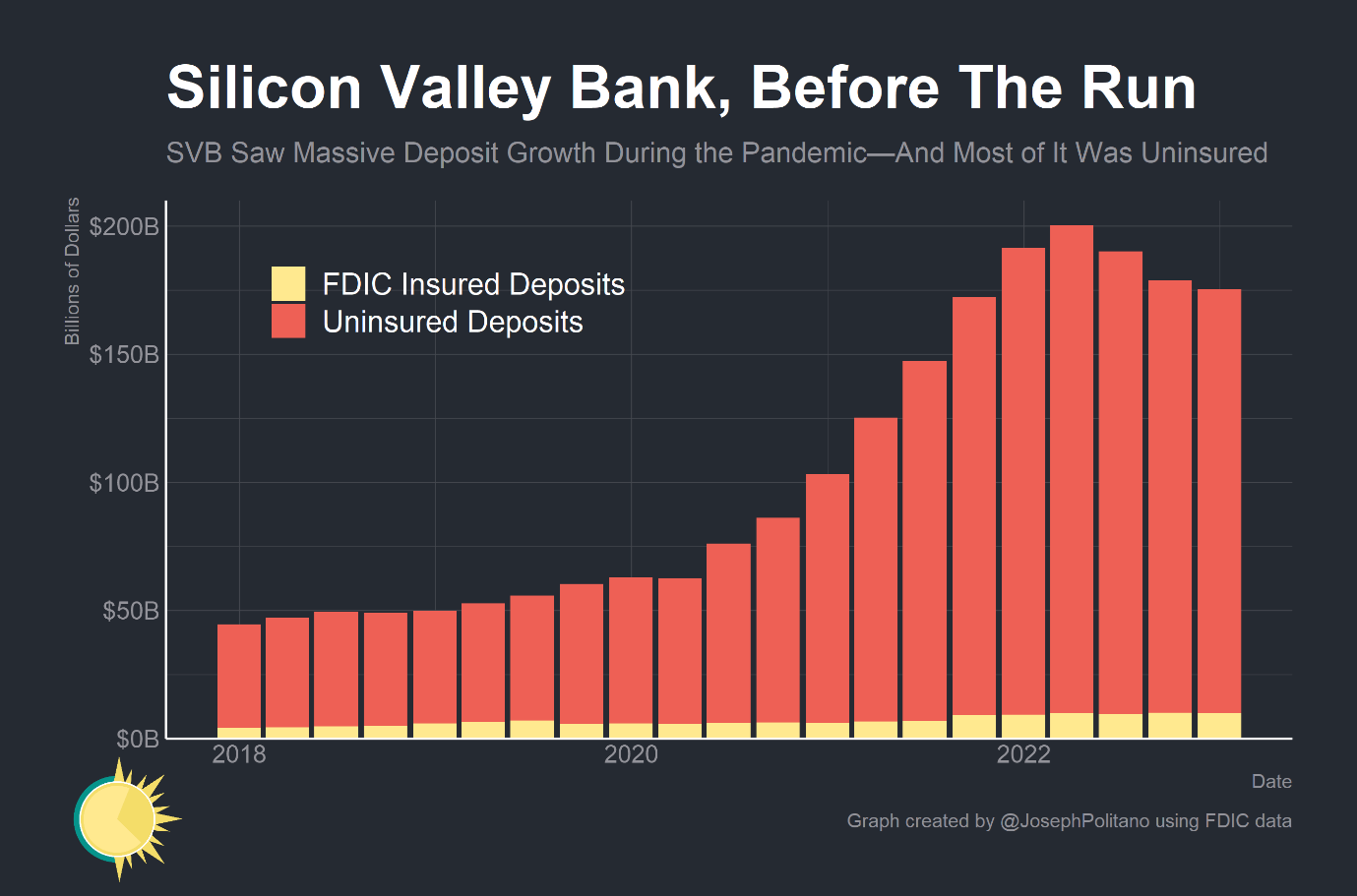

Figure 3. SVB Insured Deposits. (Source: Apricitas Economics, 2023)

Assets

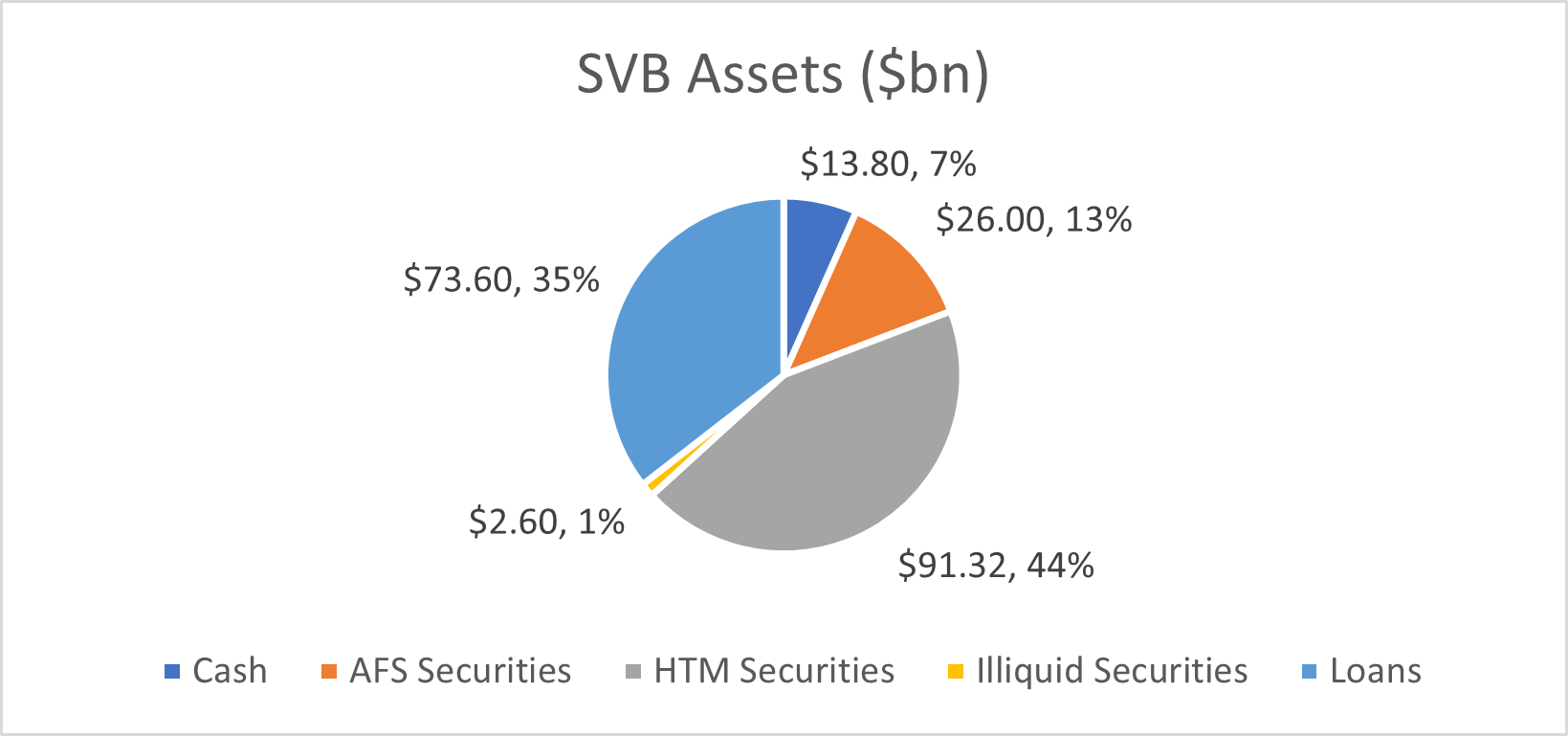

Figure 4. SVB Assets. (Source: SVB Annual Report, 2022)

As explained previously SVB had a choice between holding its assets in a HTM bucket or an AFS bucket. It chose to place 44% in HTM, which means those securities couldn't be protected from changes in interest rates. As interest rates rise, this has a negative impact on the value of government bonds. So, this decision to invest into the HTM group was made to avoid reporting losses on those securities in their financial reports. The bank could have protected the other assets in a bucket called AFS, but they didn't in 2022. This was a risky move, particularly as the Federal Reserve had signalled that interest rates would be rising to deal with inflation. The bank claimed that hedging would hurt their profit margins, but this turned out to be a costly mistake.

The final nail in the coffin

Some depositors became worried about the bank and started withdrawing their funds. To meet these demands, the bank was forced to sell some of its AFS securities and raise capital by selling new shares. This caused other depositors to panic and withdraw their funds, resulting in a total of $45 billion being taken out of the bank in just one week. The bank was unable to fulfill these requests, as the HTM assets to which they were too heavily exposed could only be sold at discounted prices due to the higher interest rate environment and hence SVB was shut down. It was a classic bank run, but it was caused by the bank's poor risk management, greed, and lack of diversification in funding sources. The good news is that this could be interpreted as poor management afflicting one bank rather than a systemic crisis.

What was the regulatory response?

After the bank's failure, regulators took quick action. The Federal Reserve, Federal Deposit Insurance Corporation (FDIC), and Treasury Department declared the bank to be systemically important and guaranteed all deposits, including those that were uninsured. To prevent future bank runs, the Fed created a new lending facility that allows banks to use HTM bonds as collateral for borrowing at face value instead of market value. This is important because it means that banks can access funds to fulfill withdrawal requests even if the value of their HTM bonds has fallen below market value, thus avoiding the liquidity issue which compromised SVB. At a systemic level, we expect this to avert a 2008-style crisis.

Impact on markets?

The market reaction has been swift, with global bank stocks and broader equity markets falling. Swiss banking giant Credit Suisse, in particular, was hit hard, and the Swiss National Bank stepped in with liquidity guarantees.

Subsequently Switzerland’s biggest bank, UBS, stepped in and agreed to rescue its compatriot bank, which has meant that after initial turmoil the markets appear to have calmed somewhat, for now.

In sovereign bond markets, traders have significantly increased their exposure to short-term government bonds, anticipating that Central Banks will soon cut interest rates to preserve financial stability.

Short term government bond yields are heavily influenced by central bank policy. Take a 2-year bond; the alternative for an institutional investor to investing in a 2-year bond is hold the money at the fed for two years and thus receive whatever the base rate is for the next two years. Therefore, the yield on a 2-year government bond, through arbitrage, should closely track the expectations for average base rates over a two-year period.

If traders buy into short term bonds heavily, it indicates they think that bank base rates will come down, which would led to the yield on the bond falling too, meaning they will profit (as when bond yields fall, prices rise).

Credit markets have also tightened, which means there is less accessibility to loans, which pushes the price of borrowing up, as investors expect small regional banks to lose deposits to larger banks, impairing their ability to generate credit.

It's important to note that these reactions are based on expectations at the time of writing, and may change as more information becomes available. The situation is still unfolding, and it will take time to assess the full impact on the market.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright