Markets wobble out of lockdowns

Market Update - February 2022

2021 ended with the S&P 500 reaching a record high, the FTSE 100 18% up on the year and European equities resurging with large cap equities up over 23%.

But then January brought a shock as markets fell as Central Banks outlined their intentions to raise interest rates. This came as inflation figures have risen and companies pass on higher costs to consumers, who in turn demand higher wages, contributing to a tighter labour market.

Both inflation and unemployment are key metrics for Central Banks, so in this update we look at how markets reacted last month and how interest rates and markets may evolve over the next 12 months.

Outlook from the Central Banks

Central Bank policy continues to be the main focus for investors. They have become more hawkish, which means we now expect interest rates to rise across the developed world and Central Bank balance sheets will reduce in the year ahead. A Central Bank balance sheet summarises its financial position and is made up of assets, liabilities and equity. If its liabilities increase, this means the balance sheet has increased. In order to reduce its balance sheet, the Central Bank needs to reduce its liabilities so will sell securities or cease to reinvest in maturing bonds.

The general direction is known but ‘when’ is the unknown factor, with forecasts changing month to month. Current forecasts are that the US Federal Reserve will raise rates five times this year, with the first rate hike in March then in May, July, and September – this would put US rates at 1.25-1.50%. This will also coincide with a reduction in the balance sheet, which is another form of contractionary monetary policy, and will see the Federal Reserve reduce the amount of bonds it purchases under its Quantitative Easing programme (or Quantitative tightening (QT) as we discussed last month).

In the UK, the Bank of England increased rates to 0.50% (50bps), which was widely expected. What surprised markets, however, was that four of the nine members of the monetary policy committee voted to increase rates to 0.75% (75bps). Moving forward we expect a further two rate rises this year which would put UK rates at 1%. At this point the Bank of England would consider restarting selling bonds rather than the current, modest £25bn monthly bond purchase programme.

The picture in Europe was disrupted recently when ECB President Christine Lagarde remarked that a rate rise could not be ruled out. This caused volatility in European bonds, as the outlook is that rates will remain unchanged in Europe. Medium term inflation expectations remain subdued and tightening financial conditions, so higher interest rates for example, could put even more strain on households already facing record high energy prices.

What has happened in markets?

Equity Markets shudder

Given this shift in Central Bank stance, we have seen investors rotate from growth to value focused companies. The prospect of higher interest rates means companies with higher future cash flows (or ‘growth’ companies) will have a decreased present value. This is because the discount rate (the rate at which future cash flows are valued) becomes higher. This is compared to ‘value’ Companies which have lower earnings growth but more stable revenues.

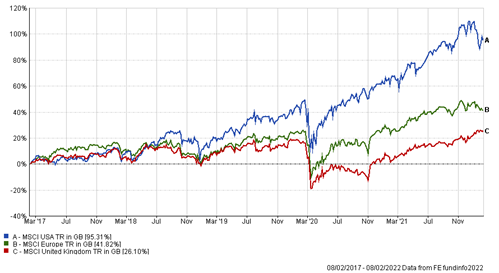

US equities, which are tilted towards growth sectors like technology, which makes up 30% of the MSCI USA index fell around 9% in January. The MSCI UK index, which has a sizeable allocation to value sectors such as consumer staples fell only c. 3% (see Figure 1.).

Figure 1: Composite of MSCI Indices performance over five years (Source: FE analytics)

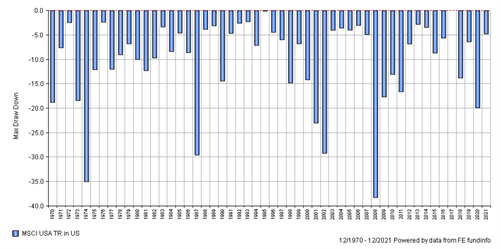

After a long positive run, an adjustment in pricing is to be expected. Looking at the MSCI USA index since 1970, the recent fall of c.9% does not look out of the ordinary, compared to past drawdown periods, especially in 1974 and 2008 respectively. (See Figure 2.)

Figure 2: MSCI USA index maximum drawdown 1970 – 2021 (Source: FE analytics)

Bonds join in the downturn

The uncertainty in interest rates and inflation has also led to volatility in fixed income markets – also known as bonds.

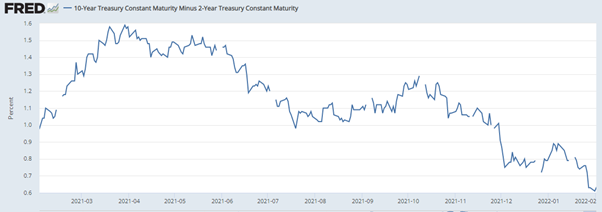

With the forecast of five interest rate hikes this year and inflation in the US at 7.3%, one would expect that longer term bond yields would rise and that the yield curve would be steepening (longer term yields are higher/rising faster than shorter term rates).

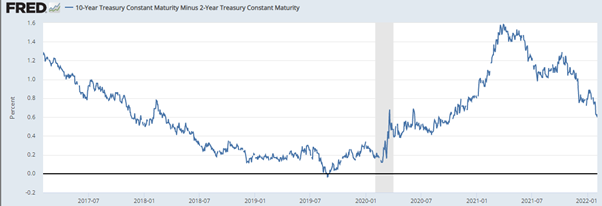

What we are seeing, however, is that the yield curve is flattening and the spread (the difference in yield) between the 10yr and 2yr bond is narrowing, meaning markets have an expectation that inflation will fall in the medium term. Markets may also be concerned that the Federal Reserve will be too aggressive when raising rates which could subdue longer term growth (see Figure 3a. and 3b.)

Figure 3a. US 10-2 year Treasury Yield Spread – January 2021 – January 2022

Figure 3b. US 10-2 year Treasury Yield Spread – January 2017 – January 2022

TPO’s Investment Committee’s base case is that longer term bond yields will rise, albeit in a gradual manner. This is driven by the Federal Reserve’s QT operation which will target medium to longer term yields (with increasing interest rates impacting shorter term rates). Also, the sheer amount of available money needing a home means that any increase in yield will be attractive to income hungry investors.

The Corporate debt market also felt the effects of the equity market volatility with an increase in the number of credit default swaps issued. Credit default swaps provide protection against Corporate debt default. The picture will become clearer over the coming months but with Corporate fundamentals strengthening; earnings growth is strong, leverage or using borrowed money, is falling, and low interest rates means interest coverage ratios (a metric of affordability) are robust, these movements seem to be driven by sentiment rather than a deterioration in companies being able to afford their debt.

Summary

TPO’s Investment Committee expects to see bouts of higher volatility throughout the year as investors react to evolving economic data and Central Banks responses. Looking beyond this, they are optimistic as the world economy continues to reopen and Corporate fundamentals are improving.

Whilst periods of higher volatility can be discomforting it’s important to consider both your investment time horizon and how your portfolio is currently positioned – the benefits of having a well-diversified portfolio become even more apparent during periods of market stress.

Note: This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions.

Investment returns are not guaranteed, and you may get back less than originally invested; past performance is not a guide to future returns.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright