A great end to 2023 but will there be a New Year hangover?

This month we take a look at some of the big factors we believe will influence the markets in 2024.

Inflation is falling towards the 2% target, but the risk remains to this aspirational target. In particular, the labour market will need to weaken further, and supply chain 'crisis' - such as the Red Sea disruption, could cause a flare up.

Interest rates are likely to be cut, although markets have been a bit too ambitious with their expectations.

Corporate earnings expectations are too high. Earnings are likely to grow, but it is more likely to be mid-single digits rather than low double digits growth.

Stocks in the US are expensive at an aggregate level, however there is a large divergence between the most and least expensive stocks. Equally, there are large gaps between how expensive the stocks of regional equity markets and sectors are. These differences in valuation could be a source of additional returns to skilled investment managers.

Economic growth will slow down in the US as excess savings - accumulated during Covid times and beyond - are spent. European and UK growth may be buoyed by remaining excess savings. Therefore, growth prospects are likely to converge.

Geopolitics will continue to be a large - and growing - factor. If the world continues to split into factions or spheres of influence then this is likely to increase costs for businesses, which creates an upside risk to inflation.

Inflation outlook remains uncertain despite recent falls

Inflation has declined notably in major economies such as the US and UK over recent months, largely driven by falling goods prices. For example, in the US, goods inflation is near zero whilst services inflation remains sticky around 5%. Chinese export prices have been falling, lowering input costs for companies globally and pulling down inflationary pressures on consumer goods – this has had a large impact and is likely to continue as Chinese industrial production continues to grow rapidly. However, risks remain that inflation may persist. The labour market will need to further weaken to bring down wage growth from around 4%, reducing consumer spending power. Supply chain disruptions also pose an upside risk if shortages re-merge or shipping lanes are further disrupted, increasing costs.

Currently, US pay growth remains around 4%, enabling higher consumer spending that can drive further price increases. As wages and prices rise in tandem, it creates a self-reinforcing inflationary cycle. Resolving this dynamic requires labour market weakness to lower wage growth momentum. We have seen progress in reducing wage growth, as higher wages have pulled workers into the labour force, increasing the participation ratio, however wage growth of around 3% is more consistent with inflation at the central bank target of 2%, according to JP Morgan.

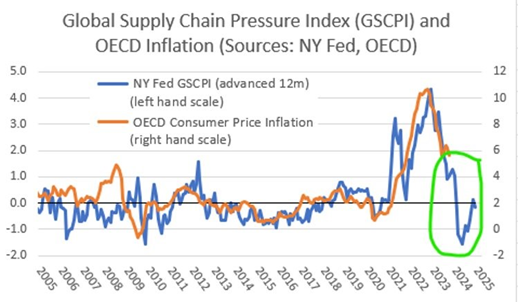

Figure 1: OECD Inflation & NY Fed Global Supply Chain Pressure Index, Source: NY Fed, OECD, 2023.

Additionally, supply chain pressures appear to be re-intensifying based on the New York Federal Reserve’s Global Supply Chain Pressure Index, pictured above. As shortages re-emerge and shipping lanes are disrupted, companies may again raise prices to preserve margins. Deglobalisation and onshoring production could also add to costs and inflationary pressures as supply chains shorten but become less efficient. The outlook remains uncertain; in the short term it looks like inflation will continue to fall but there is no room for complacency and wage-based inflation is harder to derail.

Moderating US Corporate earnings growth likely as the economy slows

With inflation declining, earnings growth is also likely to moderate from current expectations of double-digit growth in 2024. Profit margins remain near cyclical highs in many regions, including the US, Europe, and UK. As revenue growth slows in a disinflationary environment, profit margins may come under pressure. Falling headline inflation can reduce corporates' input and financing costs, but the disinflation-induced drag on nominal economic growth tends to depress corporate revenues. In such a scenario, the fall in input costs may not keep up with the fall in revenues, thus eroding corporate margins.

Current consensus forecasts anticipate around 10% earnings growth for US stocks in 2024, well above the historical average of 7.9%. However, towards the end of the economic cycle we typically see earnings roll over as demand weakens. As previously mentioned, slowing revenues amid softening economic conditions can squeeze profit margins.

Overall, we expect US corporate earnings to grow in the mid-single digits rather than optimistic low double-digit projections. Slowing earnings suggests limits to further expansion in equity valuations.

Divergent equity valuations create opportunities

Despite high valuations in the overall US stock market, there is a significant difference between the mega-cap technology stocks (such as the so called ‘Magnificent 7’) and the broader market. Valuation spreads between regions also remain near historic highs. For example, the US market trades at over 20x forward earnings compared to around 10x for UK and emerging markets.

Divergence in valuations creates potential opportunities for skilled active investment managers. An equity can get too expensive or too cheap against where it should be trading. It is more an art than a science so areas of the market can go too far and that enables good managers to generate returns by avoiding overpriced companies or sectors, while investing in areas with more attractive valuations. Managers can exploit the spreads by being selective and protecting against downside risks from expensive stocks. We expect this to be a key source of returns in excess of the movement in market indices, as managers take advantage of mispriced assets.

Economic growth convergence between US and Europe

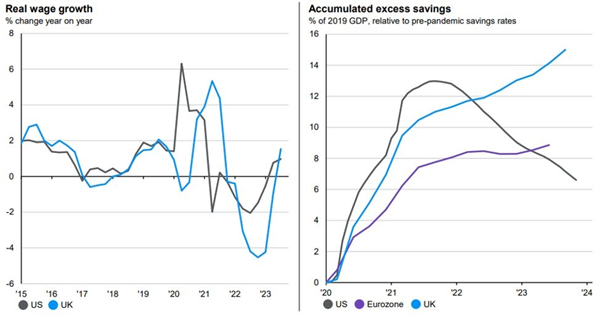

Figure 2: UK & US Real Wage Growth; US, EU & UK Excess Savings, Source: JP Morgan, 2024.

Economic growth is set to slow across most major economies in 2024. GDP growth forecasts dropped to around 1.25% for the US and close to zero for the UK. However, Europe may benefit relative to the US this year. Excess savings remain high in Europe and UK as consumers were unable to spend amid Covid related lockdowns.

As real wage growth turns positive (see left hand chart above) and excess savings are unleashed (see right hand chart), growth could improve. Meanwhile, depleted savings may act as a drag on further US growth. Additionally, fiscal policy support is constrained in the US with large deficits, while EU recovery fund grants have been underspent and could provide a boost to European economies.

Geopolitical tensions increase inflation and market risks

Rising geopolitical tensions appear set to sustain inflationary pressures and market uncertainty in 2024. As the US becomes less willing or able to police the entire globe, smaller powers are disrupting regional orders unchecked. Hotspots include Russia in Eastern Europe, Iran in the Middle East, and China in Taiwan.

Figure 3: Impact of Red Sea shipping disruptions, Source: BBC News, 2023.

For example, shipping routes are being threatened, with vessels forced into costly diversions to avoid danger zones. Yemen's Houthi rebels have begun attacking ships in the Red Sea, forcing costly diversions around Africa. If China escalated in the vital South China Sea or Russia further disrupted European gas flows, the economic impacts could be even more severe. Overall, declining global stability enables local actors to stir unrest and chaos. This unrest increases the likelihood of spikes in inflation and decrease certainty in forecasting future inflation.

Investors may need to brace for more volatility as factions and spheres of influence fragment the world order. Higher inflation risks remain amid geopolitical uncertainty. Navigating this backdrop requires skilled active management that can adapt to changing conditions and minimize downside risks.

Conclusion

In summary, while inflation has fallen substantially, an uncertain outlook remains for 2024 and the final mile from 3% to the target of 2% will be tough and will require some pain in labour markets.

Given this, it seems that investors could be disappointed by the speed and scale of interest rate cuts until this happens – albeit ‘savers’ will continue to see the benefits of historically higher rates.

The pace of earnings growth has likely peaked, with risks to profit margins as economic growth slows. Divergent regional and sector valuations create opportunities for selectivity and skilled investment management. Geopolitics introduces more volatility and inflation upside risks at a time of moderating growth.

Note: This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions. Additionally, past performance is not a guide to future returns. Investment returns are not guaranteed, and you may get back less than you originally invested.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright