December capped off a strong year for equity markets

Market Update - January 2022

December ended a strong year for equity markets, as the opening of economies, following successful vaccination programmes and fuelled by loose government policy, helped to propel corporate earnings above expectation. There was also a strong end to 2021 as volumes of transactions begin to fall over the holiday period, a lower volume of trades meant that equities can move further on less activity. There was more going on beneath the headline index levels and rotation from value to growth stocks has now started to gather pace in early 2022. Growth stocks are companies that offer the expectation of earnings growth, while value stocks appear to be undervalued in the marketplace.

Central Banks become Hawkish

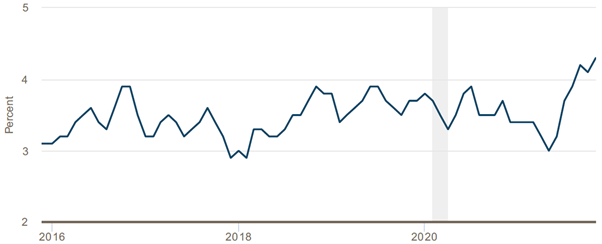

There was a marked shift in the attitude of the Central Banks in the UK and US towards monetary policy. Increasing inflation has been a feature of the reopening phase of the pandemic, as a resurge in demand chased a limited supply of goods and services, buoyed further by savings from the periods of lockdown. This environment has extended to labour markets where less freedom of movement and workers re-evaluating their lives has resulted in early retirement or job changes. There is now significant upward pressure on wages with November’s three month average wage growth recorded at a relatively high level of 4.3% (see Figure 1.).

Figure 1. US three month average median wage growth (Source: Federal Reserve Bank of Atlanta – January 2022)

Quantitative Easing (QE) becomes Quantitative Tapering (QT)

Quantitative Easing (QE) is when a Central Bank, such as the Bank of England, makes large purchases of Government Bonds. When this happens, the price of these bonds will tend to increase while the yield (the interest rate offered on the bond) decreases. Quantitative Tightening (QT) is the opposite – so the Central Bank allows the bonds it owns to mature or sells them on, thereby reducing the amount held.

Although Central Banks forecast that inflationary pressures are likely to recede in coming years, they are also worried that this period of high inflation might find its way into expectations of future inflation, which in some ways can make further inflationary pressures inevitable, especially if the employment markets remain buoyant. Throughout the last quarter of 2021, the views of both Central Banks, signalled the prospect of monetary support through bond purchases and low interest rates. The Bank of England ‘went first’ with its decision to raise interest rates, whilst continuing bond purchases (Quantitative Easing, QE). The Federal Reserve in the US has gone further by outlining plans to slow down bond purchases (Quantitative Tapering, or QT!) and the prospect of interest rate rises in 2022 to curb inflationary pressures.

Year-end performance

With the threat of the Omicron COVID variant still causing uncertainty, this caused short-term government bond yields to rise, in anticipation of future interest rate increases, whilst longer-dated government bond yields stayed flat. This so-called ‘bear flattening’ of the yield curve was a sign that bond investors are still cautious on the growth outlook. Equity investors, on the other hand, read positive signals into the data on Omicron, which, despite much higher transmissibility, was not causing a marked spike in serious illness as populations are largely now vaccinated. The year ended positively for equities and rather quiet for bonds. The impact of the Bank of England base rate rise caused GBP (British Pound Sterling) to strengthen against other currencies, thus reducing some of the gains from owning overseas assets for Sterling investors.

Rotation from Growth to Value?

A key feature of the falling interest rate environment since the global financial crisis of 2008 has been the willingness of investors to attach current higher valuations of companies rather than to those companies with good long-term growth prospects. With interest rates and inflation staying low for so long and with many companies able to produce reliable growth, investors placed a premium on such companies. Over the same period, so-called value stocks, which are more exposed to the economic cycle, have been out of favour.

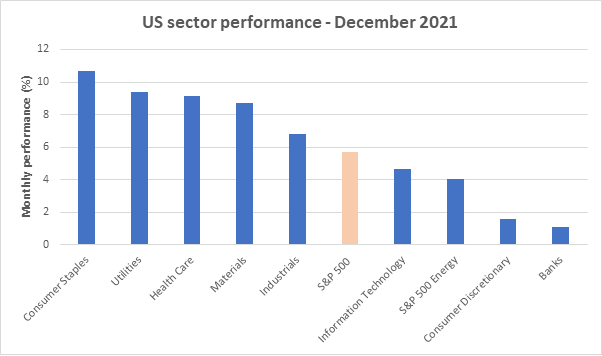

There were signs in December that higher interest rates were causing a rotation in the type of company that investors were willing to buy in the short term. Growth stocks such as technology began to underperform wider markets, while value stocks, such as utility companies, started to perform better.

As we head into 2022, this sentiment could be reversing.

Figure 2: US sector performance in December (Source: FE Analytics)

Four interest rate rises in a year?

As we entered 2022 this rotation gained traction. Longer term government bond yields jumped in reaction to further signs of the US Federal Reserve’s tightening of the monetary environment. The publication of the Fed’s December meeting minutes made their fear of inflation clear. These minutes resolved not only to end bond purchases, and raise interest rates in 2022, but to reduce the size of their balance sheet by selling assets (QT). In the pre-Christmas market this might have been greeted by fears that economic growth could suffer as a result. For now though, investors are downplaying the threat posed by Omicron (or future variants of COVID) and are looking forward to the pandemic becoming endemic, so more localised. This predicts a world where we live with the virus and the Fed and other Central Banks are having to be more aggressive with policy.

Looking to the year ahead, what does this mean?

The relative fortunes of growth, value, and technology versus cyclical movements with the economic cycle, look to be intertwined with interest rates and bond yields, economic growth, inflation, and Central Bank policy. Ultimately, the prospects for cyclical and value will be helped by rising yields and economic recovery. If that falters, so will yields and the growth stocks will once again reassert themselves.

Our view is that yields will move higher in stages. This will allow markets to adjust in an orderly fashion, but much will depend on economic growth this year.

Global growth rebounded last year. This year growth rates are forecast to fall but the high growth seen last year was well above the historic rates. The forecast for real GDP figures (which considers the high inflationary environment) are still positive.

There are several headwinds which could disrupt growth such as the finding of a new COVID variant, or inflation being more persistent, however, we see the base case as a return to normal.

In this environment we would expect a continuation of improving corporate fundamentals, especially for those sectors adversely affected by the pandemic, but also recognising that the market will continue to be sensitive to key macro-economic data and ongoing Central Bank rhetoric.

Note: This Market update is for general information only, does not constitute individual advice and should not be used to inform financial decisions.

Investment returns are not guaranteed, and you may get back less than originally invested; past performance is not a guide to future returns.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright