Compounding Interest… The Eighth Wonder of the World

Looking at the current economic climate, it’s easy to feel disheartened. With wage stagnation, high levels of inflation leading to higher costs of living and volatile markets, these factors add to the challenge of trying to maximise your wealth. Luckily, if you have time on your side, compounding can prove an excellent way to help achieve your financial goals and plan for a comfortable retirement.

Simply put, compounding allows an investor’s money to grow over a period of time, where the interest that is paid, is based on both the initial investment, as well as any accumulated earnings from these investments. This is referred to as a form of exponential growth, where the interest being earned increases, and the increase becomes more rapid. Effectively you earn interest on interest and the longer this goes on the more interest, in theory, you earn.

To put this idea of exponential growth into perspective, if someone offered you £1 million today, or a magic £1 coin that doubled in value every day for 30 days… which would you pick? You might be happy choosing the first option, but at the end of the 30-day period, your magic £1 coin would be worth more than £1 billion! Now we can start to understand why Albert Einstein allegedly referred to compounding as the Eighth Wonder of the World.

Compounding in Action

When looking at different types of interest, it would be useful to go back to basics and understand the two main types of interest: simple and compound.

Simple interest is added, based only on the initial amount invested. For example, if you invested £1,000 and earned 5% simple interest per year, you would always earn £50 a year, this is because the 5% is consistently calculated using the initial amount you invest (ignoring any interest that has already been paid). On the other hand, compound interest calculates the amount of interest due, based on the initial investment (£1,000) as well as the interest that has been accrued from previous years. So, in year two, you would earn 5% on £1,050, which would equate to £52.50.

The table below shows a comparison of the differences between these two types of interest. Both examples are based on an investment of £1,000, held for 5 years and using an annual interest rate of 5%.

| End of Year | Investment | Simple Interest | Compound Interest | Difference |

|---|---|---|---|---|

| 0 | £1,000 | £1,000 | £1,000 | - |

| 1 | £1,050 | £1,050 | £0 | |

| 2 | £1,100 | £1,102.50 | £2.50 | |

| 3 | £1,150 | £1,157.62 | £7.62 | |

| 4 | £1,200 | £1,215.51 | £15.51 | |

| 5 | £1,250 | £1,276.28 | £26.28 |

As expected, we can see the simple interest being added remains consistent, as it will only ever be based on the initial amount invested. In contrast, the compound interest account shows a greater amount of interest being added after the first year, where the interest being added is based on the initial investment, as well as the interest paid in the previous year. We can also see that the difference between the simple and compound interest accounts is increasing exponentially.

You may be looking at the figures in year 5 and feel that an extra £26 won’t make a huge difference to your long-term financial security, but now that we understand the basics of how compounding interest works, we can look at how to maximise the outcome.

The Magic Ingredient … Timing

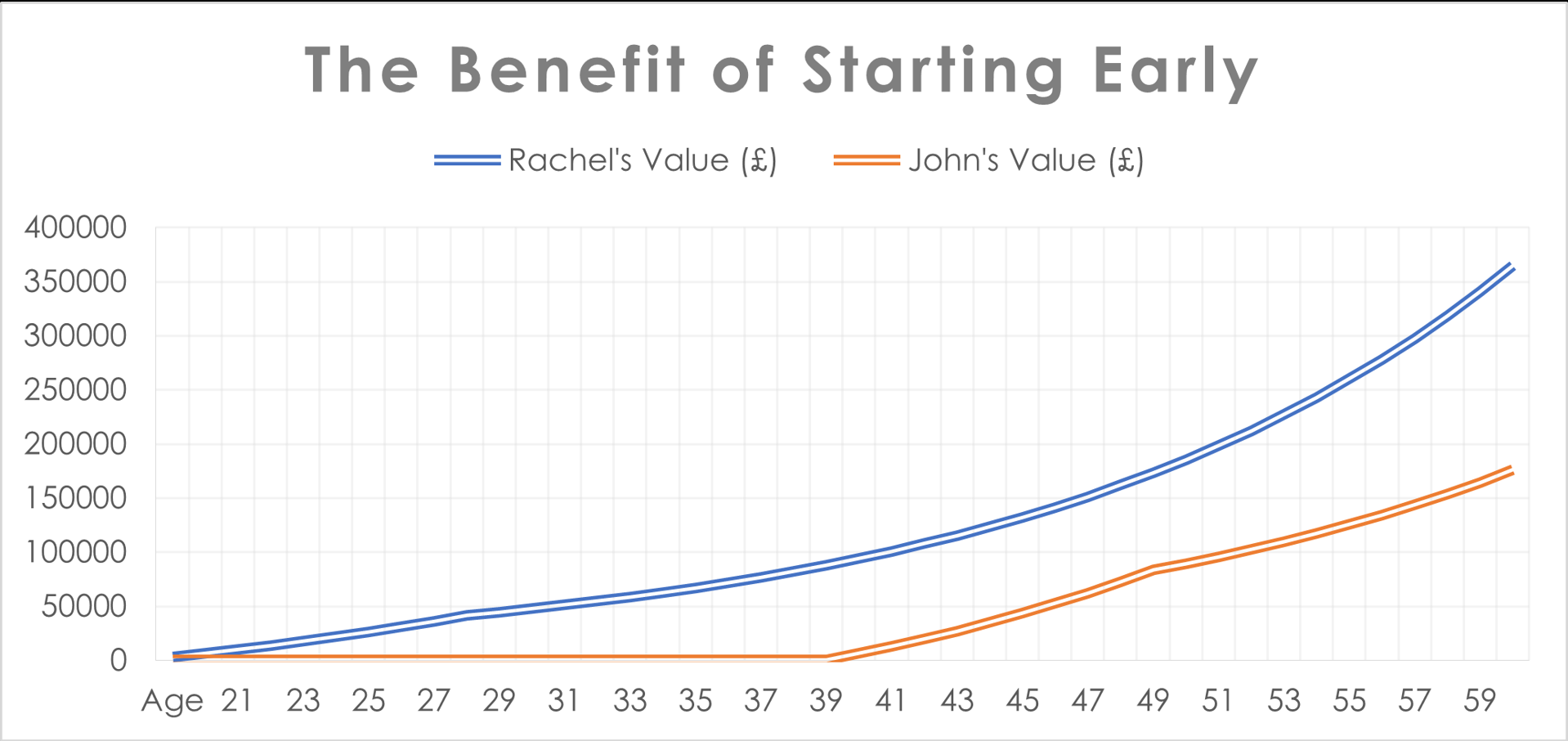

In order to maximise the benefits that can be experienced through compounding, there is a very simple fact to keep in mind, when you start investing outweighs how much you save. To illustrate this point, let’s look at another example with Rachel and John.

- Rachel starts saving early, at the age of 20, and puts away £250 per month (£3,000 per year) into an account earning 5% compound interest. She continues her regular payments for 10 years and then leaves the account untouched until she retires at 60.

- John starts a bit later, at the age of 40, but to make up for his delay, he puts away £500 per month (£6,000 per year) into an account earning 5% compound interest. As Rachel did, he continues his regular payments for 10 years and then leaves the account untouched until he retires at 60.

Over the course of the 40-year period, John has invested £60,000 compared to Rachel who has saved just £30,000, yet Rachel’s account has a higher value when she comes to retire, by around £42,000. This highlights the benefit of having time on your side when it comes to compound interest; the return that Rachel has earned by starting to save earlier is snowballing. The effect is so drastic that John can’t catch up, even by saving twice as much as Rachel. This illustrates the point, it’s less about how much you can save, and more about when you start, but of course, saving more will certainly improve the outcome!

Compound Interest and Investing

So far, we have considered how compound interest works when investors are provided with the same 5% return each year, but in reality, investment returns aren’t this consistent. Since 1993, The MSCI World Index (a commonly used indicator of global equity performance) has experienced an average annual return of 11.7%, however, this figure doesn’t highlight the long ‘flat’ periods and the numerous years providing negative returns.

To even out the impact of volatile markets, and to maximise the potential benefit of compounding while investing, time is crucial and starting early is key. Investments should be held for at least 5 years in order to balance the natural fluctuations that occur, and the risk of getting back less money than you invested increases if you hold your investment for a shorter period of time.

How to get started?

If you are early in your career, it can be difficult to find the surplus income to start saving regularly, however, starting to save now can give you the best chance of achieving your goals, and maximising your wealth in the future.

Regardless of your situation, Investment Champion are here to support you in finding an investment solution that is well suited to your needs. Our aim is to make investing feel as simple and straight forward as possible so that you can feel confident that you are making the right decisions.

Why not get in touch to learn more or simply get started with investing and see how Investment Champion can support you through your investment journey.

Note: The Value of investments can fall as well as rise. You may get back less than you originally invested.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright