Cash vs Investing: Making the right financial moves

Managing your finances is an essential aspect of achieving your long-term financial goals. Two common approaches to managing money are holding cash and investing it. Each strategy has its pros and cons, and understanding the differences and benefits between them is crucial for making informed financial decisions.

With interest rates on cash at levels not seen in many years, you might be wondering if it's better to invest or shift your hard-earned money into cash. However, before you rush to a decision, it's important to understand the roles of both cash and investments in a diversified portfolio.

CASH

Is often considered the safety net; as cash provides liquidity and stability. It's there when you need it for emergencies or immediate financial needs. This readily available resource allows you to weather life's unexpected storms without needing to dip into investments.

INVESTING

Involves allocating your funds into assets like stocks, bonds, property or alternatives with the expectation of generating returns over the long term. While investing comes with inherent risks, it offers the potential for significant wealth accumulation and the potential to outpace inflation.

A well-diversified portfolio of investments will have a balance of assets in cash as well as invested assets for the following reasons:

- History has shown us that the average bear market, which is defined as a ‘prolonged drop in investment prices, generally experienced when a broad market index falls by 20% or more’, lasts for an average of 9 months, with the longest bear market, since 1950 lasting two and a half years. Suggesting that a cash buffer of between one- and three-years’ worth of expenditure should be enough to help you ride out periods of falling markets.

- Currently cash rates are very attractive with easy access accounts offering around 5.20% and one year fixed rate bonds offering over 6%. Making your cash monies sweat for you is important if you are going to keep 1-3 years’ worth of expenditure in cash.

- For short term monies cash is the only way to ensure the capital value of your money does not fall significantly should you not have the time frame for market recovery.

- For medium to long term, holding cash leaves you subject to inflation risk as the value of cash erodes over time, potentially reducing its purchasing power.

For example: In the UK, the best instant access savings accounts offer around 5 per cent interest. With inflation at 6 per cent, that is a real return of minus 1 per cent. Five years ago, deposit rates were 0.8 per cent with inflation at 1.8 per cent. Giving an identical real return.

- Expectation of future cash savings rates are that now that have stopped rising at some point will start to fall again meaning in 5 years’ time you may not be able to still get 5.20% on your easy accessible cash.

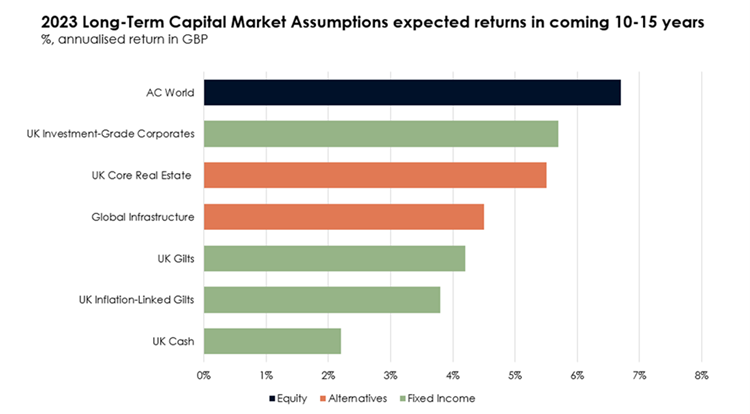

As shown by the below chart from JP Morgan, cash over a 10-15 year period is expected to return significantly lower compared to Equities or Fixed Income. Therefore, further enforcing why it is important to hold your nerve during market volatilities and keep your medium-long term monies invested.

The Flaw in Timing the Market

One common temptation when interest rates on cash look enticing is to time the market. The idea is to move money into investments when the market is promising, then shift back to cash when it seems like a safer bet. The problem is that market timing rarely works in practice. Instead, it's more about time in the market.

A recent study by Unlimited Funds, found that you would need to make the correct decision regarding timing the market 67.5% of the time. The best hedge fund managers make the correct decision 55% of the time. I.e. you would probably need to be the best hedge fund manager in the world to outperform a multi-asset portfolio by moving in and out of cash over the long-term.

Another aspect to consider is the risk involved in selling your investments and trying to time the market to buy back in. This strategy can often lead to losses. Emotional decisions or incorrect predictions about market trends can result in buying high and selling low, which is the opposite of a successful investment strategy.

The tax consequences of trying to “time the market” can also be punitive.

The Cost of Missing Out on the Best Days

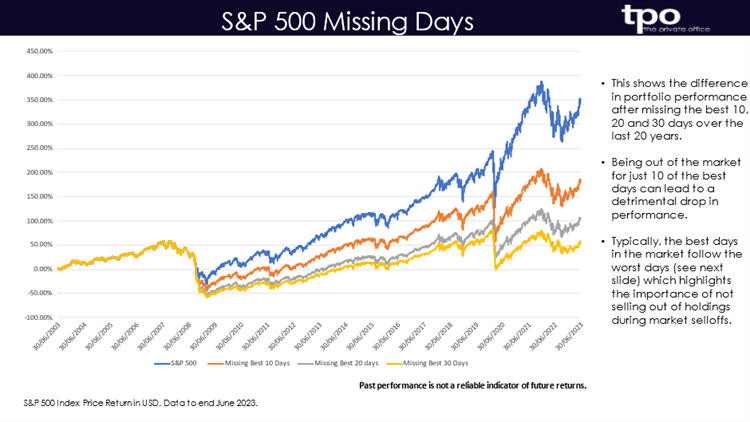

As you consider shifting funds to cash to capitalise on higher interest rates, think about the potentially enormous cost of missing out on the best-performing days in the market. History shows that some of the most significant market gains happen in brief, unexpected spikes. Missing just a handful of these days can profoundly impact your long-term returns.

As shown in the below graph, missing just 10 of the best days in the market can decrease your return by 164.71%. So, if you invested £100,000 and stayed invested the whole time over the 20 year period your portfolio would return £347,560. If you missed the 10 best days your returns over the same period would be £186,320.

In the end, the best approach is balance. A diversified portfolio that includes both cash and investments to offer the best of both worlds. This approach allows you to have the safety of cash when needed while also benefiting from the growth potential of investments over time.

Rather than attempting to outsmart the market, focus on your long-term financial goals. Keep a substantial portion of your portfolio in investments suited to your risk tolerance and maintain a reserve of cash for immediate financial needs.

The current landscape of appealing cash interest rates can be tempting, but making knee-jerk reactions to market fluctuations can lead to missed opportunities and potential financial losses. While cash plays a critical role in your financial plan, striking a balance between cash and investments is the key to building and preserving your wealth over time. Remember, the financial journey is a marathon, not a sprint.

Please note:

This article is intended as information only and does not constitute individual advice. If advice is required, please ensure this is sought prior to taking any action or inaction.

The value of investments can go down as well as up, you may not get back what you originally invested. Past performance is not a guide to future returns.

The FCA does not regulate cash advice.

- Terms & Conditions

- Privacy Policy

- Key Investor Information

- Complaints

- About us

- Our fees

- FAQs

- Contact us

- Sitemap

- The Private Office

- Savings Champion

As with all investing, your money is at risk. The value of your investments can go down as well as up and you could get back less than you put in. Read more information about risk here. The tax treatment of your investment will depend on your individual circumstances and may change in the future. You should seek financial advice if you are unsure about investing.

Investment Champion Online Limited is an Appointed Representative of The Private Office Limited, which is authorised and regulated by the FCA. Both companies are registered in England and Wales with a registered office at 2 The Bourse, Leeds LS1 5DE. Dealing and custody services are provided by Hubwise Securities Limited which is authorised and regulated by the Financial Conduct Authority FRN: 502619.

Copyright